Key Takeaways

-

Medicare has four main parts: A, B, C, and D, each covering different aspects of healthcare. Knowing what each part covers can help you make informed choices.

-

Costs vary for each part, with premiums, deductibles, and co-pays playing a role in how much you pay out of pocket.

Medicare Doesn’t Have to Be Confusing

Trying to figure out Medicare can feel like you’re deciphering a secret code. With all the different parts, costs, and coverage options, it’s no wonder so many people find it overwhelming. But the truth is, Medicare isn’t as complicated as it seems—once you break it down into its four main parts. Let’s walk through them like we’re having a casual chat, so you can finally get a clear picture of how Medicare works.

Part A: The One That Covers Hospital Stays

Think of Medicare Part A as your hospital insurance. If you ever need to stay overnight at a hospital, this is the part that kicks in to help cover the costs.

What Does Part A Cover?

-

Inpatient hospital care

-

Skilled nursing facility care (short-term, not long-term care)

-

Hospice care

-

Some home health services

How Much Does It Cost?

Most people get Part A without paying a monthly premium, as long as they or their spouse worked and paid Medicare taxes for at least 10 years. However, there’s still a deductible to pay when you’re admitted to the hospital, plus daily co-insurance costs if you have an extended stay.

Part B: The One That Covers Doctor Visits

Medicare Part B is your medical insurance, covering everyday healthcare needs like doctor visits and preventive care.

What Does Part B Cover?

-

Doctor visits

-

Outpatient care

-

Preventive services (screenings, vaccines, wellness visits)

-

Some home health care

-

Durable medical equipment (like wheelchairs and oxygen)

How Much Does It Cost?

Part B requires a monthly premium, and there’s also an annual deductible. Once you meet that deductible, Medicare covers 80% of the approved amount, and you pay the remaining 20%. Keep in mind, this doesn’t include additional services like dental or vision care.

Part C: The One That Combines It All (But With a Catch)

Medicare Part C, also known as Medicare Advantage, is a bundled option offered by private insurers. It combines Part A and Part B coverage and often throws in some extras like dental, vision, and hearing benefits.

What Does Part C Cover?

-

Everything covered under Part A and Part B

-

Additional benefits (varies by plan, but may include dental, vision, and wellness programs)

What’s the Catch?

Even though Medicare Advantage plans include the same coverage as Original Medicare, they operate within provider networks, which means you might be limited in where you can go for care. Costs and coverage can vary significantly from one plan to another, making it crucial to review your options carefully.

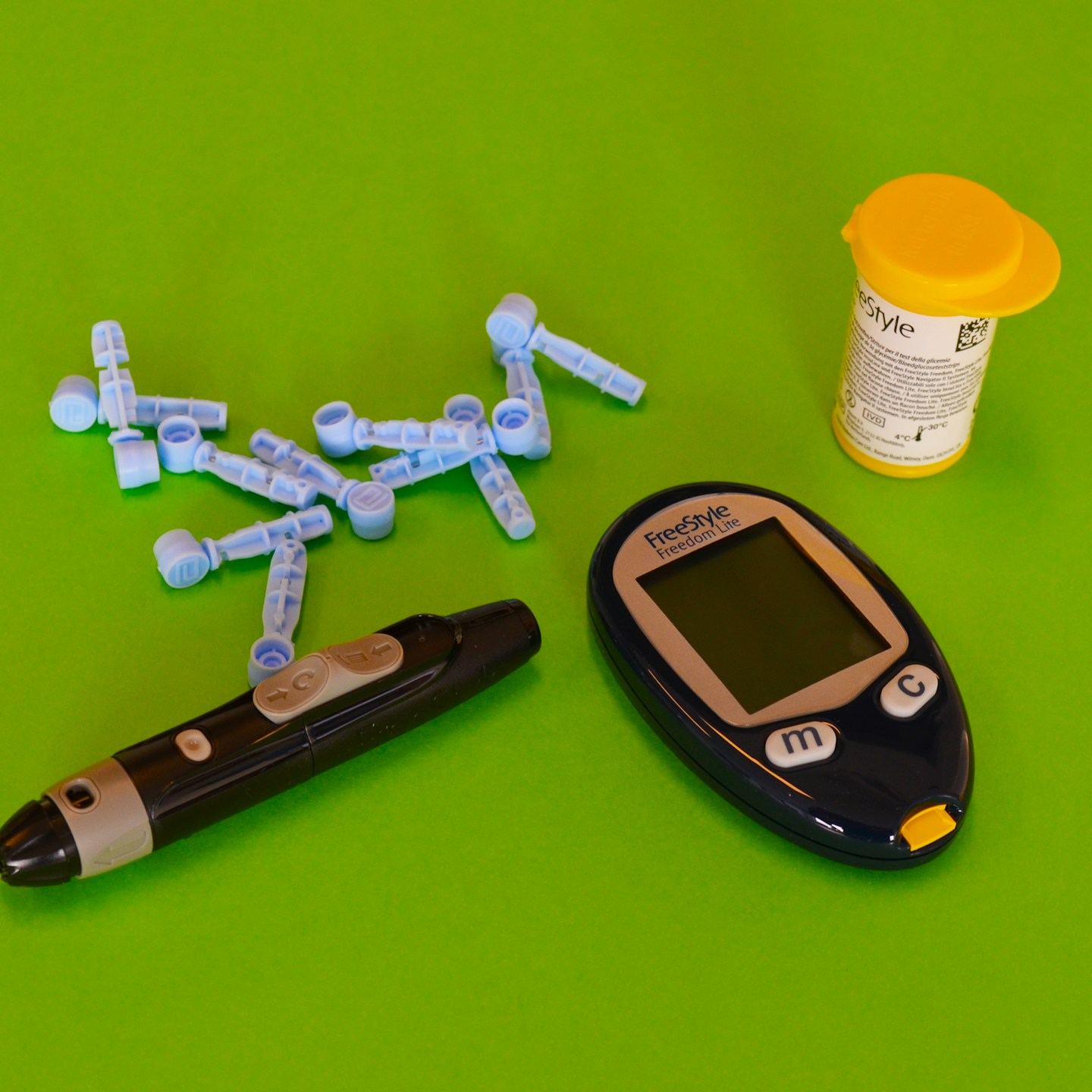

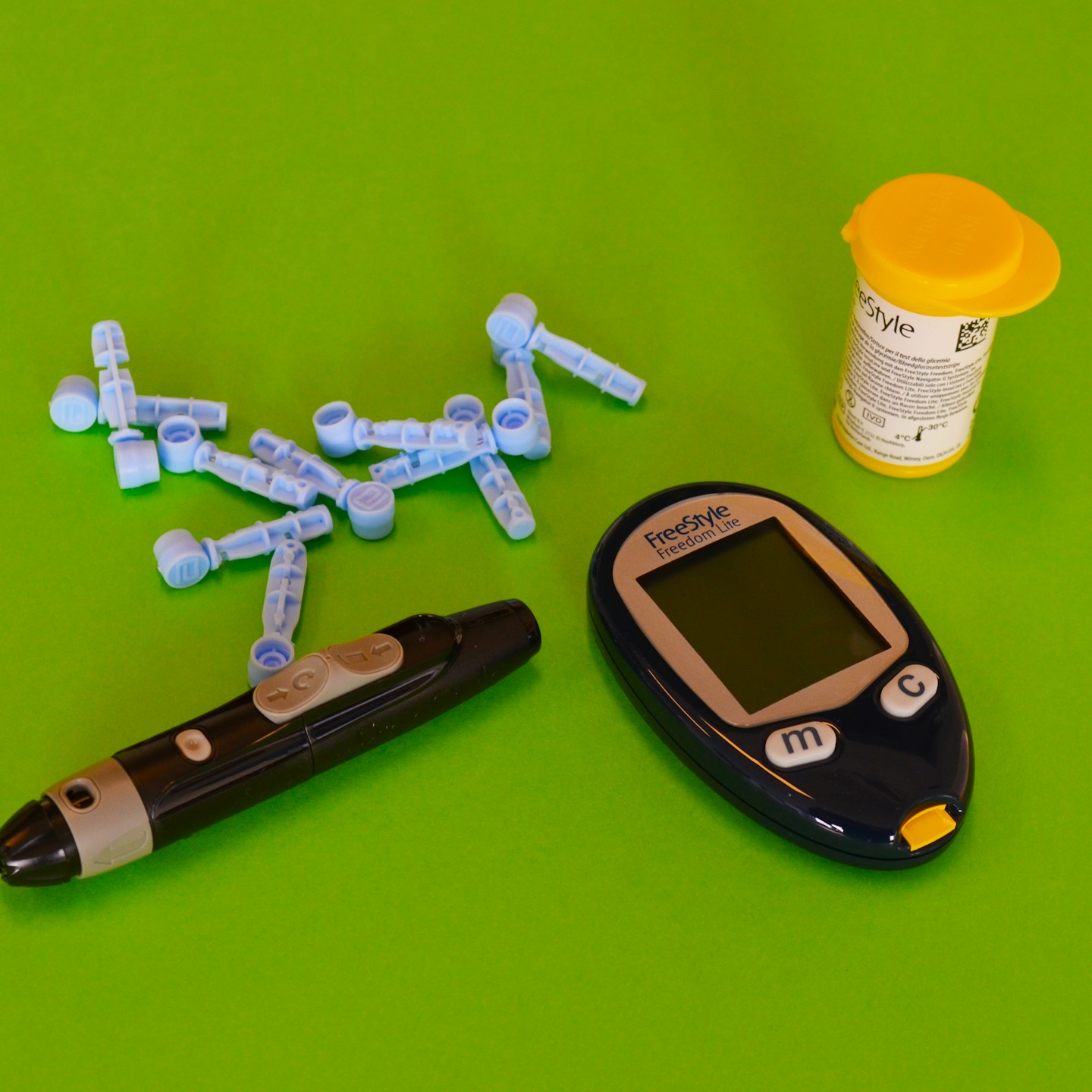

Part D: The One That Covers Prescription Drugs

Medicare Part D is all about helping you pay for prescription medications. Since Original Medicare (Parts A and B) doesn’t include drug coverage, you’ll need to enroll in a Part D plan separately if you want coverage for your medications.

What Does Part D Cover?

-

Prescription drugs (coverage varies by plan and is divided into different tiers)

-

Vaccines not covered under Part B

How Much Does It Cost?

Part D plans come with a monthly premium, an annual deductible, and co-pays or coinsurance for each prescription. The good news? In 2025, there’s a new $2,000 out-of-pocket cap for prescription drug costs, meaning you won’t pay more than that for covered medications in a given year.

Understanding Costs: Premiums, Deductibles, and Co-Pays

Medicare isn’t free, and each part comes with its own set of costs. Here’s a quick breakdown of the three main expenses you’ll encounter:

-

Premiums: Monthly payments you make to have coverage (Part A is usually premium-free, but Part B, C, and D all have premiums).

-

Deductibles: The amount you must pay out of pocket before Medicare starts covering costs.

-

Co-pays & Coinsurance: The portion of medical expenses you pay after meeting your deductible.

Knowing these costs upfront can help you plan for healthcare expenses and avoid surprises.

How to Enroll in Medicare

You’re eligible for Medicare at age 65, but you can also qualify earlier if you have certain disabilities or health conditions.

Enrollment Periods to Keep in Mind

-

Initial Enrollment Period (IEP): A 7-month window around your 65th birthday when you can first sign up.

-

General Enrollment Period (GEP): Runs from January 1 to March 31 each year if you missed your initial window.

-

Special Enrollment Periods (SEP): Available if you qualify due to life events like losing employer coverage.

Signing up at the right time can help you avoid late penalties, which can increase your costs permanently.

Medicare and Other Insurance: How They Work Together

If you have other health insurance, like coverage through an employer or a spouse, Medicare may not be your primary insurer. Understanding how Medicare coordinates with other insurance can save you money and prevent coverage gaps.

-

If you have employer coverage: If you or your spouse are still working and have insurance, Medicare might act as a secondary payer.

-

If you have retiree coverage: Some retirees keep employer-sponsored benefits, which may help cover costs that Medicare doesn’t.

It’s worth reviewing your options to make sure you’re maximizing your benefits.

What If You Need Extra Coverage?

If you want help covering out-of-pocket costs, you can look into supplemental coverage, such as:

-

Medicare Supplement Insurance (Medigap): Helps cover costs like deductibles, copays, and coinsurance for Original Medicare.

-

Medicare Savings Programs: State-run programs that help lower-income beneficiaries pay Medicare premiums and out-of-pocket costs.

These options can provide additional financial protection depending on your healthcare needs.

You Don’t Have to Figure This Out Alone

Medicare may seem overwhelming, but you don’t have to go through it alone. A professional listed on this website can help you compare options, understand costs, and ensure you’re choosing the right coverage for your needs.