Key Takeaways

-

Medicare Part D coverage can change every year due to shifting formularies, premium adjustments, and evolving federal guidelines.

-

Reviewing your Annual Notice of Change (ANOC) each fall is critical to ensure your plan still meets your medication and financial needs.

Medicare Part D Isn’t Set in Stone

When you enroll in a Medicare Part D plan, it’s natural to assume the coverage you chose will stay consistent. But in reality, prescription drug plans under Medicare are subject to annual revisions. These changes can directly impact your out-of-pocket costs, covered medications, pharmacy networks, and even access to certain drugs.

Whether you take medications daily or occasionally, understanding how and why your plan may change each year helps you avoid costly surprises and keep your care uninterrupted.

What Drives the Annual Changes?

Each fall, Medicare Part D plans submit updates to the Centers for Medicare & Medicaid Services (CMS) for approval. These updates reflect several key factors:

-

Drug pricing shifts: Pharmaceutical companies adjust pricing, which affects plan costs and drug tiers.

-

Negotiation changes: Insurers renegotiate contracts with pharmacies and drug manufacturers.

-

Regulatory updates: Federal legislation or CMS regulations may introduce new rules or cost limits.

-

Formulary revisions: Plans adjust their list of covered drugs, known as the formulary, to reflect new treatments, clinical guidelines, or cost controls.

The result? Even if you stay in the same plan year to year, what you pay and what’s covered may look quite different come January 1.

Common Changes You Can Expect Each Year

Here are the most frequent ways your Medicare Part D plan may change:

1. Drug Formularies

-

Drugs may be added or removed based on clinical effectiveness or cost.

-

Medications can be moved to a higher or lower tier, impacting your copayment or coinsurance.

-

Prior authorization or step therapy rules may apply to more medications than the year before.

If a medication you rely on is dropped or moved to a higher-cost tier, your monthly costs could increase significantly.

2. Premium and Deductible Adjustments

While premiums vary by plan, they typically shift slightly each year. In 2025:

-

The average Part D premium is about $46.50.

-

The annual deductible may rise up to $590.

These adjustments affect how much you pay before your plan starts sharing the cost of your prescriptions.

3. Copayment and Coinsurance Changes

Even if the premium stays stable, what you pay at the pharmacy counter might change:

-

Copayments can increase or decrease.

-

Coinsurance percentages may be raised, especially for specialty or non-preferred drugs.

Keep in mind that a small shift in coinsurance can mean big differences if your medication costs thousands per month.

4. Pharmacy Network Modifications

Plans often update which pharmacies are considered in-network, preferred, or out-of-network. That means:

-

Your current pharmacy might no longer be part of your plan’s preferred network.

-

You may need to switch to a new pharmacy to avoid higher costs.

-

Mail-order options or specialty pharmacy access could be limited or changed.

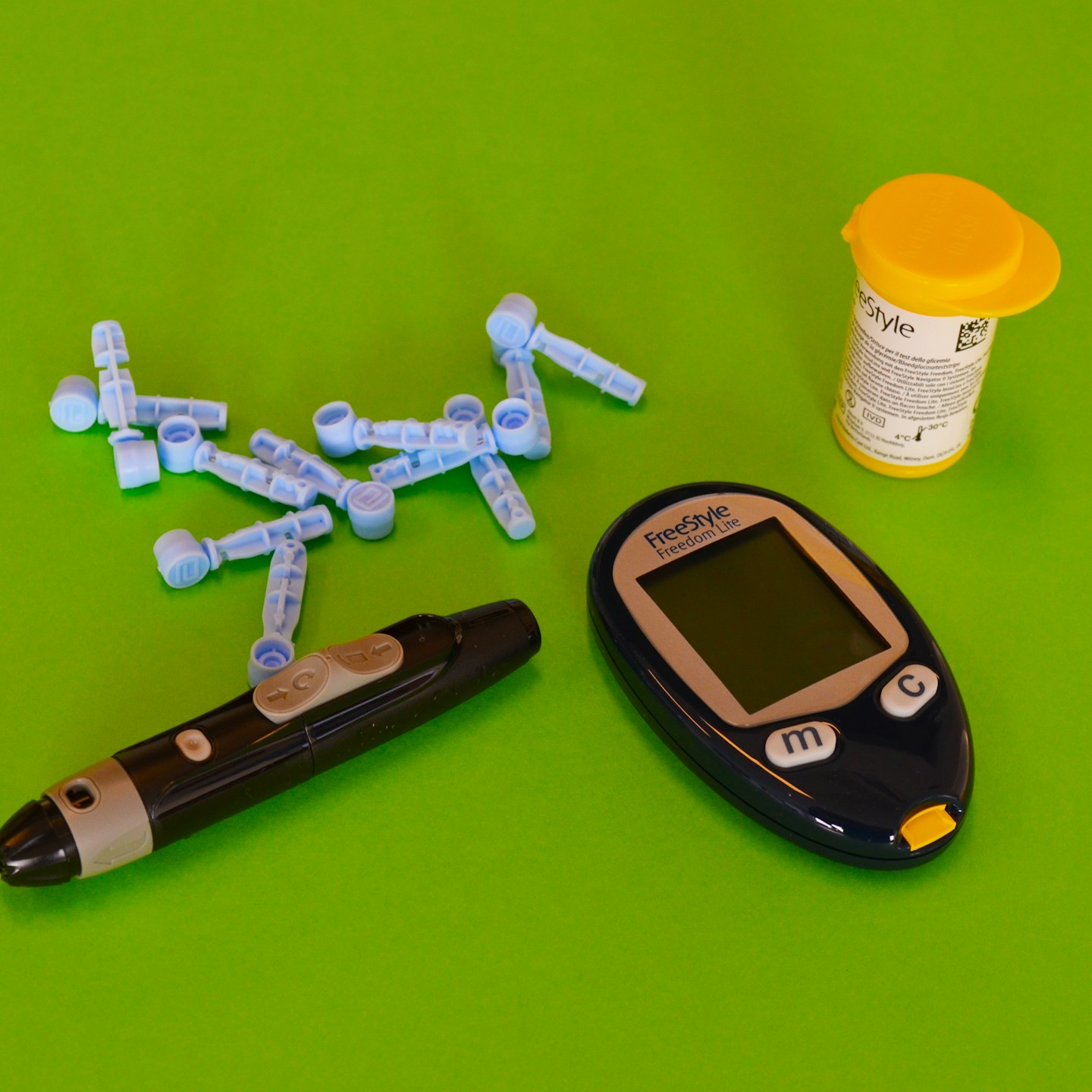

5. Out-of-Pocket Cost Cap for 2025

One significant change for 2025 is the new $2,000 out-of-pocket cap on prescription drug expenses under Part D. Once you reach this limit, your plan covers 100% of your covered medications for the rest of the year. This change eliminates the previous coverage gap (or “donut hole”) and brings relief to those with high medication costs.

However, how quickly you reach this cap still depends on your plan’s cost-sharing structure and drug pricing.

6. New Supplemental Programs

Plans may introduce or drop programs such as:

-

Medication Therapy Management (MTM)

-

Chronic condition drug support programs

-

Home delivery benefits

These value-added features can improve your medication adherence or convenience, but they vary significantly between plans and years.

Timing of Changes and What You Should Watch

Most of these changes go into effect on January 1 each year. You’ll be notified about the specifics by the Annual Notice of Change (ANOC), which arrives by September 30.

This document outlines changes to:

-

Drug coverage and costs

-

Pharmacy network participation

-

Premiums and deductibles

Reviewing this notice every fall is essential, especially during the Medicare Open Enrollment Period from October 15 to December 7. That’s your annual opportunity to:

-

Switch to a different Part D plan

-

Enroll in a Medicare Advantage plan that includes drug coverage

-

Return to Original Medicare and join a standalone Part D plan

Missing this window could mean being locked into a plan that no longer suits your needs for the next calendar year.

How to Evaluate Your Part D Plan Each Year

To ensure you’re getting the best coverage, make a habit of reviewing these elements annually:

1. Your Current Medications

-

Make a list of all prescriptions, including dosage and frequency.

-

Check if any have been moved to a different tier or dropped altogether.

2. Pharmacy Preferences

-

Confirm whether your preferred pharmacy is still in-network or preferred in your plan.

-

Compare the cost of your medications at different local or mail-order pharmacies.

3. Your Health Changes

-

New diagnoses or changes in your medication regimen may require broader coverage.

-

Some plans offer enhanced benefits for chronic conditions—see if they now apply to you.

4. Plan Ratings and Customer Feedback

-

Each Medicare plan receives a star rating (1 to 5 stars).

-

Higher-rated plans may offer better service, accuracy, and overall satisfaction.

Compare your plan’s rating with others available in your ZIP code to determine if a switch may be worth it.

5. Total Annual Costs

Don’t just look at premiums—evaluate:

-

Annual deductible

-

Copays and coinsurance per drug tier

-

Costs based on your specific drug list

CMS’s Medicare Plan Finder tool is updated each fall with current pricing and can help you estimate total yearly spending.

Why Not All Changes Are Bad

While some updates may increase your costs, others can be beneficial:

-

New generic drugs may become available, reducing your expenses.

-

Lower drug prices can lead to reduced coinsurance.

-

The $2,000 cap provides major relief for beneficiaries with high drug usage.

The key is staying informed. Ignoring the changes could mean paying more or losing access to necessary medications.

What Happens If You Do Nothing?

If you don’t take any action during Open Enrollment, you’ll automatically be re-enrolled in your current plan for the next year—even if it has changed.

This passive renewal might work fine in some cases, but it comes with risks:

-

Your medications may no longer be covered.

-

Your costs may increase without warning.

-

Your pharmacy may become out-of-network, increasing what you pay.

Taking time each fall to review your options could protect your health and your wallet.

Staying Ahead of Annual Shifts

You can reduce stress and avoid surprises by following a few key habits:

-

Set a calendar reminder for late September to read your ANOC.

-

Use the Medicare Plan Finder tool to compare options during Open Enrollment.

-

Keep a current list of your medications to make comparisons easier.

-

Ask questions early—don’t wait until December to get clarification.

If the process feels overwhelming, professional help is available.

Understanding Your Coverage Helps You Stay in Control

Prescription drug plans under Medicare are dynamic. They adapt annually to changes in the pharmaceutical market, regulations, and plan structures. While these changes can bring both challenges and opportunities, the more you stay engaged with your coverage, the better positioned you are to get the care you need—at a cost you can manage.

If you’re unsure about what to do next, reach out to a licensed agent listed on this website. They can walk you through your plan details, explain how the changes impact you, and help you compare available options.