Key Takeaways:

- Medicare Advantage plans offer additional benefits beyond Original Medicare, providing comprehensive coverage options.

- Understanding these extra benefits can help beneficiaries make informed choices about their healthcare needs.

Extra Benefits in Medicare Advantage Plans You Should Know About

Medicare Advantage plans, also known as Part C, offer a range of additional benefits not typically covered by Original Medicare (Parts A and B). These plans are provided by private insurance companies approved by Medicare and aim to offer more comprehensive healthcare options. Here are some of the key extra benefits you should know about when considering a Medicare Advantage plan.

Comprehensive Dental Coverage

One of the significant advantages of Medicare Advantage plans is the inclusion of comprehensive dental coverage. Original Medicare does not cover routine dental care, leaving beneficiaries to pay out of pocket for services like cleanings, fillings, extractions, and dentures. However, many Medicare Advantage plans include dental benefits, which can cover:

- Routine Cleanings and Exams: Regular dental check-ups to maintain oral health.

- Fillings and Extractions: Treatment for cavities and removal of problematic teeth.

- Crowns and Bridges: Restorative procedures to repair damaged teeth.

- Dentures and Implants: Solutions for missing teeth, enhancing both functionality and aesthetics.

By providing these services, Medicare Advantage plans help beneficiaries maintain better oral health and avoid the high out-of-pocket costs associated with dental care.

Vision Care and Eyewear Benefits

Vision care is another area where Medicare Advantage plans offer additional benefits. Original Medicare only covers eye exams related to certain medical conditions, such as diabetes or cataract surgery. Medicare Advantage plans, on the other hand, often include:

- Routine Eye Exams: Annual exams to monitor eye health and vision changes.

- Eyeglasses and Contact Lenses: Coverage for prescription glasses or contact lenses, including frames and lenses.

- Discounts on LASIK Surgery: Some plans offer discounts on corrective eye surgeries like LASIK.

These vision benefits ensure that beneficiaries can maintain their eyesight and detect potential issues early, reducing the risk of more severe problems down the line.

Hearing Exams and Hearing Aids

Hearing loss is a common issue among older adults, yet Original Medicare does not cover hearing aids or routine hearing exams. Medicare Advantage plans often fill this gap by offering:

- Routine Hearing Exams: Annual tests to assess hearing health and detect changes.

- Hearing Aids: Coverage for hearing aids, including fitting and maintenance.

- Hearing Aid Batteries: Some plans also cover the cost of batteries for hearing aids.

By including these benefits, Medicare Advantage plans help improve the quality of life for beneficiaries with hearing impairments, ensuring they can stay connected and engaged with their surroundings.

Fitness and Wellness Programs

Promoting overall health and wellness is a key focus of many Medicare Advantage plans. These plans often include fitness and wellness programs designed to keep beneficiaries active and healthy. Common offerings include:

- Gym Memberships: Access to fitness centers and gyms, often through programs tailored to seniors.

- Exercise Classes: Group classes for yoga, pilates, strength training, and more.

- Wellness Coaching: Personalized coaching to help with fitness goals, nutrition, and weight management.

These programs encourage physical activity and healthy lifestyles, which can help prevent chronic conditions and improve overall well-being.

Transportation Services for Medical Appointments

Access to reliable transportation can be a significant barrier to receiving healthcare, especially for those with mobility issues. Medicare Advantage plans often address this by providing transportation services for medical appointments. This benefit can include:

- Rides to Doctor Appointments: Scheduled rides to and from medical appointments, ensuring beneficiaries can attend necessary check-ups and treatments.

- Transportation to Pharmacies: Rides to pharmacies to pick up prescriptions and other medical supplies.

By offering transportation services, these plans help ensure that beneficiaries do not miss important medical appointments due to lack of transportation.

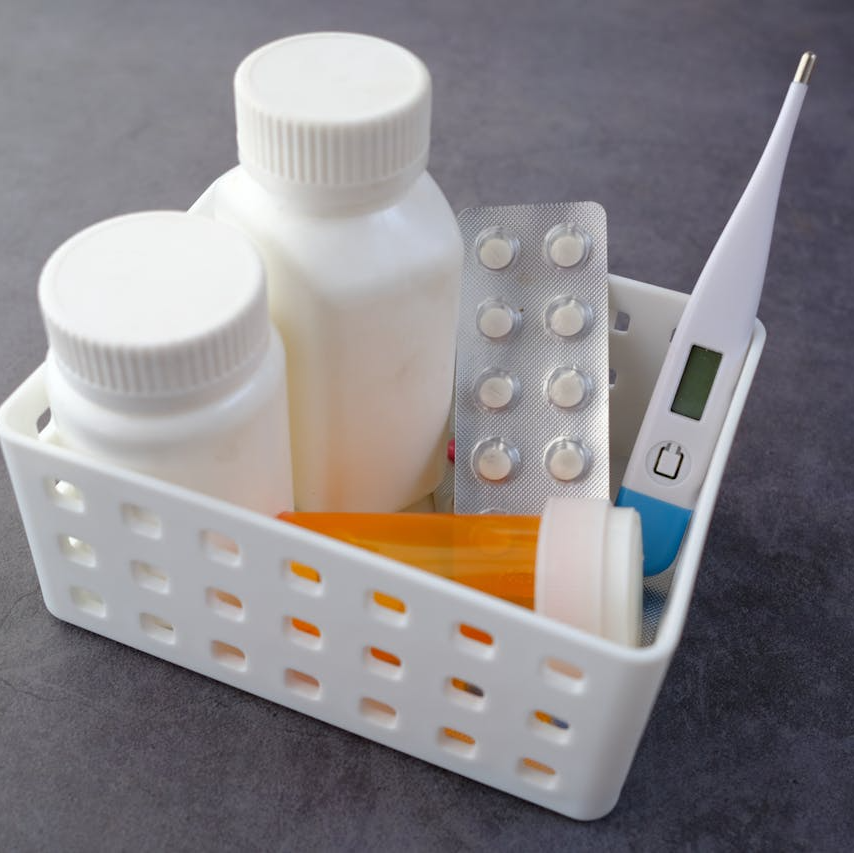

Over-the-Counter Allowances

Many Medicare Advantage plans provide allowances for over-the-counter (OTC) medications and health products. This benefit allows beneficiaries to purchase items such as:

- Pain Relievers and Fever Reducers: Medications for common ailments.

- Vitamins and Supplements: Nutritional supplements to support overall health.

- First Aid Supplies: Bandages, antiseptics, and other first aid items.

- Personal Care Products: Items like toothpaste, shampoo, and lotion.

The allowance typically comes in the form of a quarterly or monthly benefit, enabling beneficiaries to access essential health products without additional out-of-pocket expenses.

Meal Delivery Services Post-Hospitalization

Nutrition plays a crucial role in recovery, especially after hospitalization. Some Medicare Advantage plans offer meal delivery services to beneficiaries who have recently been discharged from the hospital. This benefit can include:

- Nutritionally Balanced Meals: Prepared meals designed to meet dietary needs and support recovery.

- Home Delivery: Convenient delivery to the beneficiary’s home, ensuring access to healthy meals during the recovery period.

This service helps ensure that beneficiaries receive proper nutrition, which is essential for healing and maintaining strength after a hospital stay.

Home Health and Personal Care Services

Medicare Advantage plans often provide additional home health and personal care services not covered by Original Medicare. These services can include:

- In-Home Care: Assistance with activities of daily living such as bathing, dressing, and meal preparation.

- Skilled Nursing Care: Medical care provided by a licensed nurse in the beneficiary’s home.

- Physical Therapy: Rehabilitation services to help regain strength and mobility.

These home-based services can significantly improve the quality of life for beneficiaries, allowing them to receive necessary care in the comfort of their own homes.

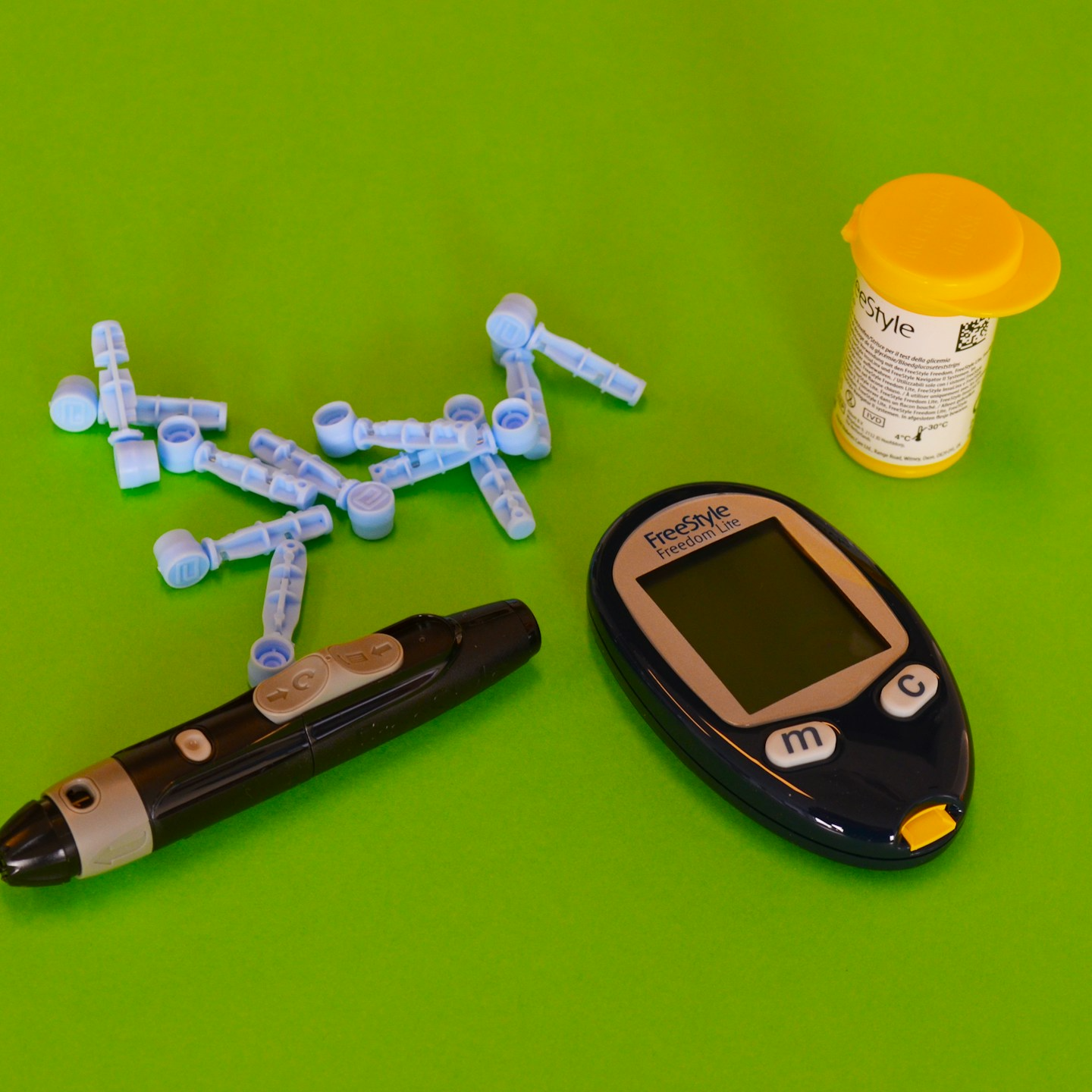

Telehealth and Virtual Care Options

Telehealth and virtual care have become increasingly important, especially in recent years. Medicare Advantage plans often include enhanced telehealth benefits, such as:

- Virtual Doctor Visits: Consultations with healthcare providers via video call.

- Remote Monitoring: Devices and apps that allow for the remote tracking of vital signs and health conditions.

- Mental Health Services: Access to counseling and therapy through virtual platforms.

These telehealth options provide convenient access to healthcare services, reducing the need for in-person visits and helping beneficiaries manage their health more effectively.

Emergency and Urgent Care Coverage Abroad

For beneficiaries who travel internationally, Medicare Advantage plans often offer emergency and urgent care coverage abroad. This benefit can include:

- Emergency Medical Services: Coverage for emergency medical treatment received while traveling outside the United States.

- Urgent Care Services: Access to urgent care facilities for non-emergency situations that require prompt attention.

- Medical Evacuation: Coverage for medical evacuation services if needed.

This coverage provides peace of mind for beneficiaries who travel, ensuring they can receive necessary medical care even when they are far from home.

Conclusion

Medicare Advantage plans offer a wide range of additional benefits that go beyond the coverage provided by Original Medicare. From comprehensive dental and vision care to fitness programs and telehealth services, these extra benefits can significantly enhance the healthcare experience for beneficiaries. Understanding these benefits can help individuals make informed decisions about their healthcare coverage and ensure they have access to the services they need to maintain their health and well-being.

Contact Information:

Email: [email protected]

Phone: 9165556789