Key Takeaways

-

Medicare Part B plays a critical role in covering outpatient services, but it does not provide complete protection against all healthcare costs.

-

Understanding what is covered, what is not, and where out-of-pocket costs arise is essential to avoid unexpected expenses in retirement.

What Medicare Part B Covers in 2025

Medicare Part B, one of the two parts of Original Medicare, helps pay for a wide range of medically necessary outpatient services. In 2025, it continues to provide coverage for the following:

Doctor Visits and Outpatient Care

You are covered for:

-

Primary and specialist visits

-

Outpatient hospital services

-

Mental health outpatient care

-

Durable medical equipment (DME) like wheelchairs or oxygen tanks

-

Preventive screenings and services

These services are considered medically necessary by Medicare standards. Preventive services include annual wellness visits, cancer screenings, and vaccinations such as flu shots.

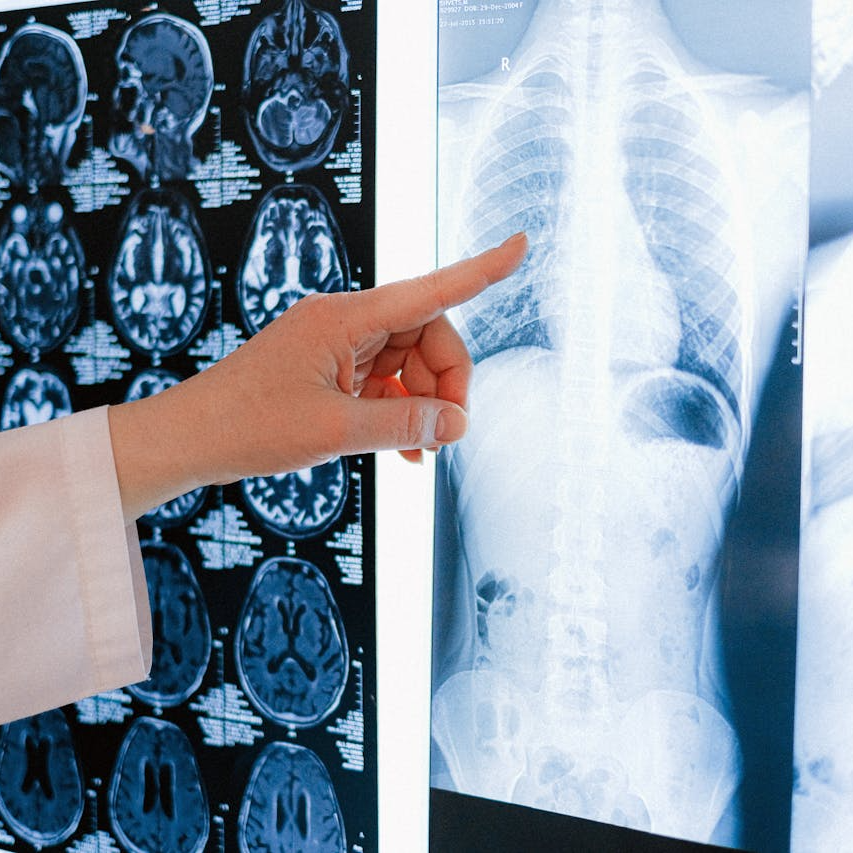

Diagnostic Tests and Lab Work

Medicare Part B pays for most:

-

Blood tests

-

X-rays and MRIs

-

CT scans

-

EKGs and other diagnostic screenings

These services are essential for identifying health issues early, but they often come with coinsurance, which means you may still pay 20% of the Medicare-approved amount.

Ambulance Services

When medically necessary and no other safe transport option is available, Medicare Part B covers ambulance services. However, air ambulance transport may require additional documentation to prove necessity.

Outpatient Surgeries and Therapies

Surgeries that do not require an overnight hospital stay are typically covered. So are:

-

Physical therapy

-

Occupational therapy

-

Speech-language pathology

In all these categories, you are responsible for 20% of the Medicare-approved amount after meeting your annual Part B deductible.

The Gaps in Part B Coverage

Despite the breadth of services Part B offers, it does not pay for everything. Several significant gaps could lead to high out-of-pocket costs.

Prescription Drug Coverage

Medicare Part B only covers a limited number of prescription drugs, usually those administered in a doctor’s office, such as:

-

Injectable or infused drugs for cancer

-

Certain vaccines not covered under Part D

However, regular prescriptions you pick up at a pharmacy are not covered. You need Medicare Part D or another form of drug coverage to avoid paying full price.

Dental, Vision, and Hearing Services

Part B does not cover:

-

Routine dental exams or procedures

-

Eye exams for glasses or contact lenses

-

Hearing exams or hearing aids

While medically necessary treatments related to these services may be covered (like cataract surgery or jaw reconstruction after trauma), routine care and devices are excluded.

Long-Term Custodial Care

If you require assistance with daily activities such as bathing, dressing, or eating over an extended period, Medicare Part B does not provide coverage. Custodial care in a nursing home or at home is not covered unless skilled nursing services are medically necessary.

International Medical Care

Generally, Medicare Part B does not cover healthcare you receive outside the United States and its territories. There are rare exceptions, such as if you’re in the U.S. when a medical emergency occurs near a foreign border.

Understanding the Costs in 2025

Even when Medicare Part B covers a service, it rarely covers 100% of the cost. Here’s how the cost-sharing structure breaks down for 2025:

Premiums

The standard monthly premium for Medicare Part B in 2025 is $185. Individuals with higher incomes may pay more based on income-related monthly adjustment amounts (IRMAA).

Annual Deductible

Before Part B pays its share, you must meet the annual deductible of $257.

Coinsurance

After meeting the deductible, you typically pay 20% of the Medicare-approved cost for services. There is no out-of-pocket maximum with Original Medicare, so your expenses can grow quickly with frequent or high-cost care.

Enrollment and Timing Rules

Being timely with your Part B enrollment is crucial. Delaying without proper coverage could cost you both financially and in terms of future eligibility.

Initial Enrollment Period (IEP)

You are first eligible for Medicare during a 7-month window:

-

Begins 3 months before the month you turn 65

-

Includes your birth month

-

Ends 3 months after

If you enroll during the first three months, your coverage begins on the first day of your birthday month. If you delay, your start date may be pushed further out.

Special Enrollment Period (SEP)

You can delay Part B without penalty if you have creditable coverage through an employer or union. Once that coverage ends, you have 8 months to enroll under a Special Enrollment Period.

Missing the SEP means waiting for the General Enrollment Period and facing a late enrollment penalty.

General Enrollment Period (GEP)

Runs from January 1 to March 31 each year. If you enroll during this time, your coverage begins July 1. A penalty of 10% for each full 12-month period you were eligible but not enrolled will apply for as long as you have Part B.

How to Fill the Gaps in Part B Coverage

Because Medicare Part B does not include drug, dental, vision, hearing, or extended care benefits, many beneficiaries look for ways to supplement it.

Medigap (Medicare Supplement Insurance)

Medigap policies help cover Part B out-of-pocket costs such as:

-

Coinsurance

-

Copayments

-

Deductibles

These plans do not include prescription drug coverage, so you still need a separate Part D plan.

Medicare Advantage Plans

These are offered by private insurers and bundle Part A, Part B, and usually Part D. They may offer additional benefits like dental or hearing coverage, but rules around provider networks and service areas apply.

Standalone Medicare Part D Plans

If you stick with Original Medicare and want drug coverage, a Part D plan is necessary. These plans come with their own premium, deductible, and copayment structure.

Supplemental Dental, Vision, and Hearing Plans

You may choose to buy standalone insurance plans that cover services not included in Medicare. These can add to your overall monthly costs but help reduce out-of-pocket spending.

Preventive Services: What You Get Without Cost Sharing

While most services under Part B come with coinsurance, many preventive services are covered at no cost to you if provided by a Medicare-assigned provider. These include:

-

Annual wellness visit

-

Cardiovascular screenings

-

Diabetes screenings

-

Mammograms

-

Colonoscopies

-

Vaccines for flu, COVID-19, and hepatitis B

These services aim to catch health issues early or prevent them altogether, which can reduce long-term healthcare expenses.

2025 Updates That Affect Your Part B Experience

Several changes in 2025 impact how Part B works:

-

Higher Premium and Deductible: The standard premium increased to $185, and the deductible to $257.

-

Increased IRMAA Thresholds: Higher-income earners will see adjusted premiums based on 2023 tax filings.

-

Part D Coordination: Some Medicare Advantage plans and employer group plans are now required to automatically coordinate Part B with prescription drug coverage to prevent gaps.

-

Electronic Medicare Card Access: CMS has expanded access to digital Medicare cards to reduce paperwork delays during enrollment and service.

What to Watch Out for When Relying Only on Part B

If you rely solely on Part B and skip additional coverage, you should be aware of the financial and coverage limitations:

-

No protection from high out-of-pocket costs due to the lack of a spending cap

-

No drug coverage for routine prescriptions

-

No dental, hearing, or vision care

-

No coverage for long-term or international care

Planning Around the Gaps in Part B Coverage

To make the most of your Medicare benefits in 2025, you should:

-

Review your healthcare needs annually

-

Consider whether you want more predictable out-of-pocket costs

-

Evaluate drug coverage needs and compare plans

-

Look into dental, vision, and hearing needs separately

It’s also a good idea to prepare for unexpected healthcare events. Medicare Part B offers strong outpatient support, but that support has limits.

Protect Your Healthcare Budget with Informed Choices

You deserve clarity about what Medicare Part B offers and where it falls short. While it provides essential outpatient coverage, its limitations can expose you to high costs if you don’t plan carefully. A licensed agent listed on this website can help you review your situation and explore options to protect your health and budget.