Key Takeaways

- Tailoring your Medicare coverage ensures you maximize your benefits while meeting your healthcare needs.

- Understanding the different parts of Medicare and enrollment timelines can help you make informed decisions.

Why Customizing Medicare Coverage Matters

Medicare isn’t a one-size-fits-all program. Whether you’re newly eligible or considering changes during an enrollment period, customizing your coverage allows you to align your healthcare plan with your current and future needs. From managing costs to ensuring access to specific services, your choices can significantly impact your healthcare experience.

Breaking Down Medicare: What You Need to Know

Original Medicare: The Core of Your Coverage

Medicare is divided into parts, with Original Medicare (Parts A and B) as the foundation:

- Part A (Hospital Insurance): Covers inpatient hospital stays, skilled nursing facilities, and hospice care. While most people don’t pay a premium for Part A, deductibles and coinsurance costs apply.

- Part B (Medical Insurance): Focuses on outpatient care, doctor visits, and preventive services. It comes with a standard monthly premium and an annual deductible.

Supplementing Original Medicare

Original Medicare offers comprehensive coverage but has gaps, such as the lack of prescription drug coverage and no annual out-of-pocket spending cap. Many choose to fill these gaps through additional plans.

How and When to Customize Your Coverage

Step 1: Evaluate Your Healthcare Needs

Start by assessing your medical history, anticipated healthcare needs, and prescription medications. Are you managing chronic conditions? Do you anticipate any major procedures? Your answers will guide your coverage choices.

Step 2: Understand Enrollment Periods

Medicare provides specific windows to join or make changes to your coverage:

- Initial Enrollment Period (IEP): A seven-month window surrounding your 65th birthday.

- Annual Enrollment Period (AEP): From October 15 to December 7, allowing changes to your Medicare plans.

- Special Enrollment Periods (SEP): Triggered by life events like moving or losing employer coverage.

- Medicare Advantage Open Enrollment Period: Runs from January 1 to March 31, enabling one change for current Medicare Advantage enrollees.

Missing an enrollment period could result in coverage delays or penalties, so marking your calendar is essential.

Step 3: Compare Your Options

Every Medicare enrollee has unique needs, and comparing plans during an enrollment period is crucial. Look at coverage options, premiums, deductibles, and out-of-pocket limits to determine what works best for you.

Making the Most of Preventive Services

Preventive care is one of Medicare’s standout features. Annual wellness visits, screenings for cancer and diabetes, and flu shots are all included under Part B. Using these services can help catch potential health issues early, saving you money and improving your quality of life.

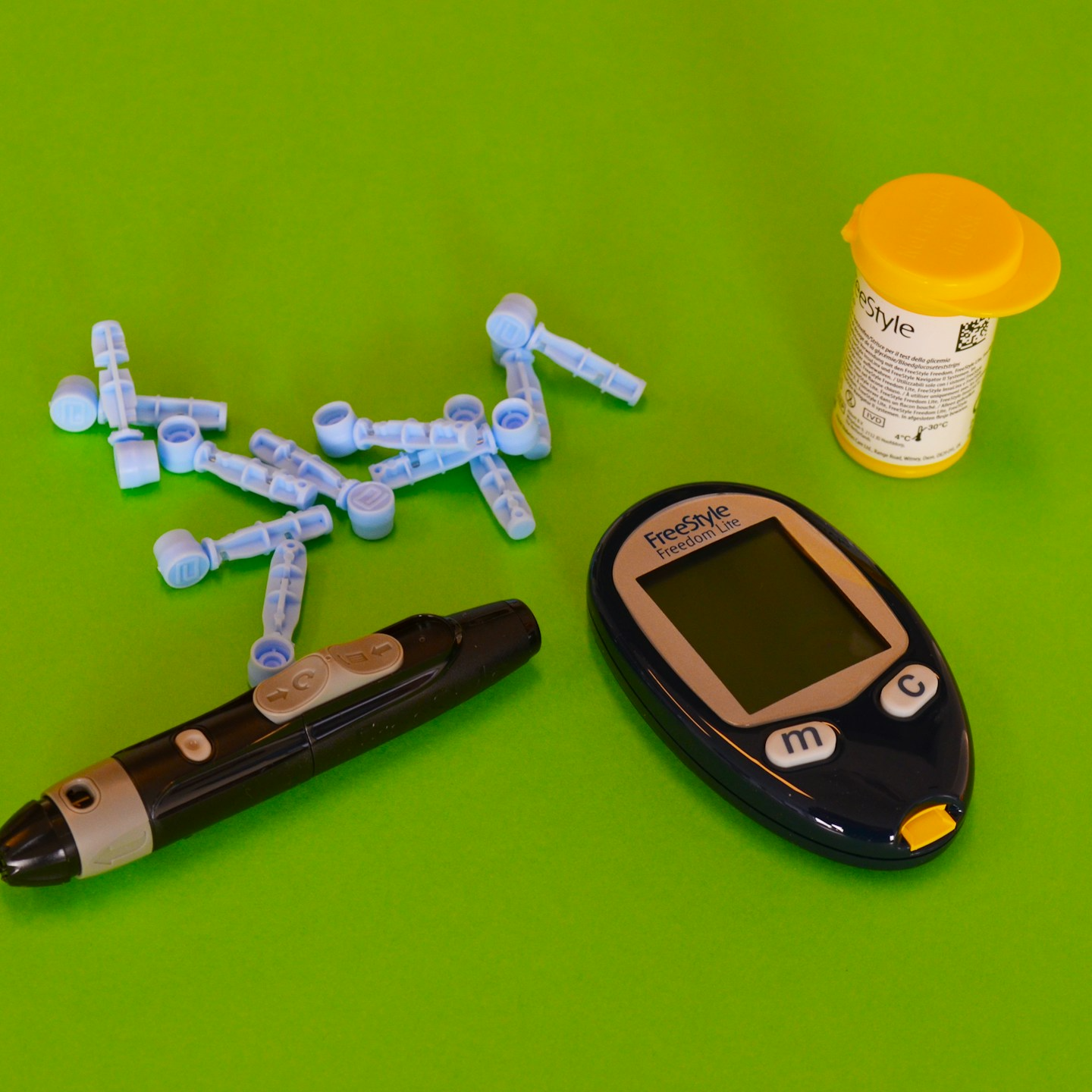

Managing Prescription Costs

Enroll in Part D for Drug Coverage

Medicare Part D provides prescription drug coverage, essential for managing medication costs. Each plan has its formulary (list of covered drugs), so review it carefully during enrollment.

Use the Deductible and Coverage Phases Wisely

Part D plans have several cost-sharing phases: deductible, initial coverage, and catastrophic coverage. Planning your medication purchases can help you navigate these phases efficiently.

Strategies to Lower Your Medicare Costs

Take Advantage of Premium-Free Part A

If you’ve worked and paid Medicare taxes for at least 10 years, you likely qualify for premium-free Part A. This is an excellent way to reduce your overall costs while maintaining robust inpatient care coverage.

Limit Out-of-Pocket Expenses

Original Medicare doesn’t cap out-of-pocket spending. Adding supplemental coverage or coordinating benefits with Medicare can help mitigate these costs.

Reassess Your Coverage Annually

Your healthcare needs can change, and so can Medicare plan offerings. By reviewing your coverage during the Annual Enrollment Period, you ensure your plan continues to meet your needs without overspending.

Planning for the Future

Medicare isn’t static, and neither are your healthcare needs. Planning for long-term changes—such as adding prescription drug coverage or choosing plans that accommodate expected surgeries or treatments—can save you stress and money later on.

Avoiding Common Medicare Pitfalls

Missing Enrollment Deadlines

Failure to enroll during your Initial Enrollment Period or other designated windows can result in late penalties. For Part B, the penalty is a lifetime increase in your monthly premium.

Ignoring Coverage Gaps

Without supplemental coverage, you could face significant out-of-pocket costs. Research and fill gaps in coverage early to avoid unexpected expenses.

Overlooking Preventive Services

Preventive care is often underutilized, even though it’s fully covered under Part B. Schedule your annual wellness visit and recommended screenings to stay proactive about your health.

Fine-Tuning Medicare for Retirement

If you’re approaching retirement, aligning your Medicare choices with your lifestyle changes is critical. Will you travel frequently? Some plans offer nationwide or international coverage, which may be essential for retirees on the move.

Additionally, consider how Medicare interacts with employer-sponsored health insurance or retiree plans. Coordination of benefits can prevent overlaps or missed coverage opportunities.

Stay Informed and Stay Covered

Customizing your Medicare coverage isn’t a one-time task—it’s an ongoing process. By staying informed about changes to Medicare policies, costs, and coverage options, you ensure your plan evolves with your needs.

Your Guide to Navigating Medicare Like a Pro

By taking the time to evaluate your needs, compare options, and review your plan annually, you’ll feel confident in your Medicare decisions. Customizing your coverage is an investment in your health, financial security, and peace of mind.