Key Takeaways:

-

Medicare offers more benefits than most people realize, including preventive services and financial protections.

-

Knowing about these lesser-known benefits can help you make the most of your Medicare coverage.

Unlock the Hidden Gems of Medicare Coverage

When you think about Medicare, your mind might immediately go to hospital stays or doctor visits. But did you know Medicare includes a variety of benefits beyond the basics? Understanding these overlooked features can not only save you money but also improve your overall healthcare experience. Let’s dive into some of the lesser-known Medicare benefits that you might not be using—but absolutely should.

Staying Ahead with Preventive Services

What Are Preventive Services?

Preventive services under Medicare include screenings, immunizations, and counseling designed to detect and address health issues early. These services can help prevent illnesses or complications, keeping you healthier for longer.

Covered Screenings and Immunizations

Medicare Part B covers various preventive measures at no additional cost when you use providers that accept Medicare. These include:

-

Annual wellness visits

-

Screenings for diabetes, heart disease, and cancer

-

Flu, pneumonia, and hepatitis B vaccines

Why should you take advantage of these? Early detection often leads to better outcomes, and Medicare has made it easier than ever to access these benefits.

Manage Chronic Conditions with Ease

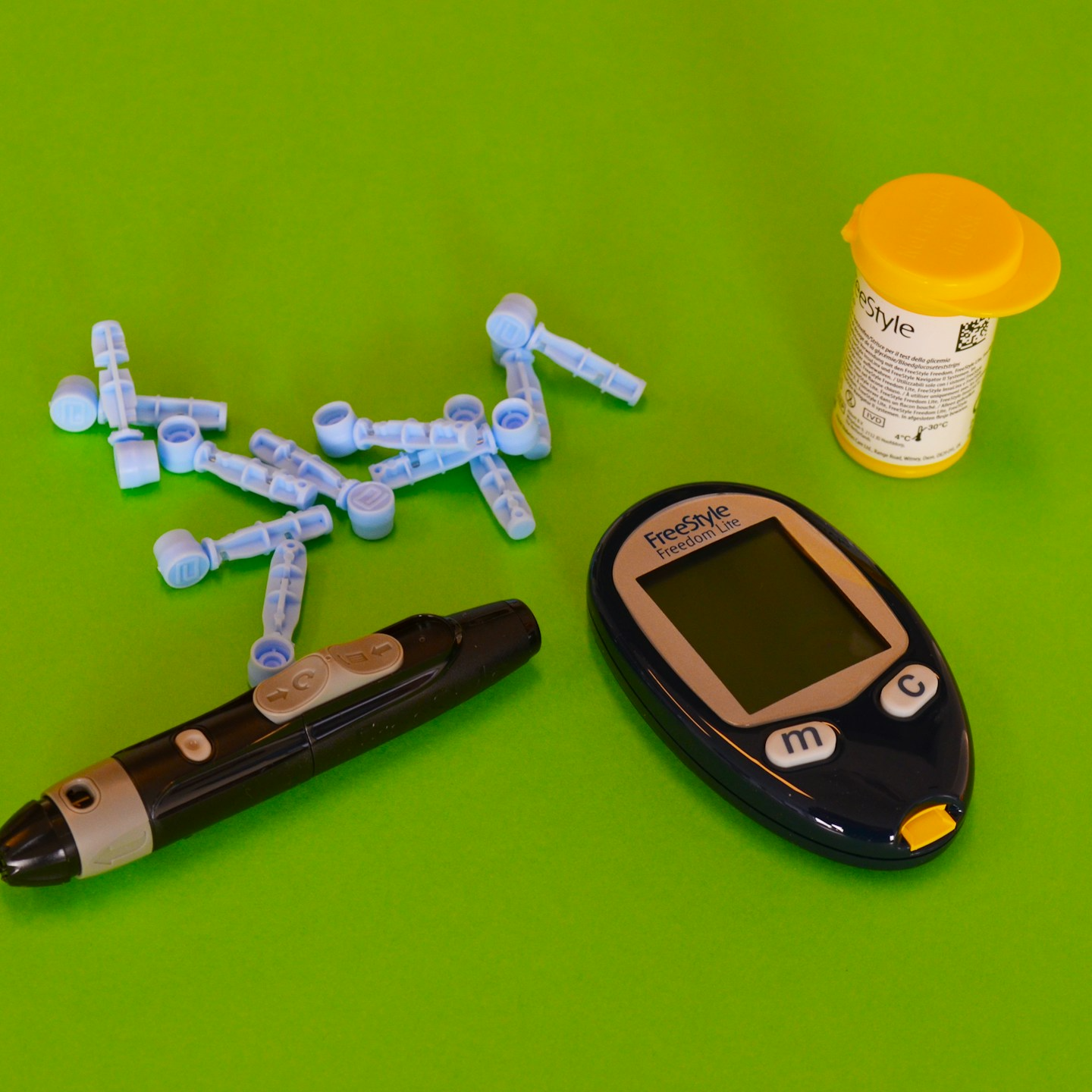

The Chronic Care Management Program

Medicare’s Chronic Care Management (CCM) program is a game-changer for those with two or more chronic conditions like diabetes, arthritis, or hypertension. This program provides coordinated care, ensuring that all your healthcare providers are on the same page. It can help prevent complications and improve your quality of life.

What’s Included?

With CCM, you get access to services like:

-

Regular check-ins with your care team

-

Personalized care plans

-

Coordination between specialists

Ask your doctor if you qualify for CCM. It’s a valuable tool that’s often underutilized.

Financial Protections You Need to Know About

The Medicare Savings Programs

If healthcare costs are weighing you down, Medicare Savings Programs (MSPs) could be a lifeline. These state-run programs can help cover premiums, deductibles, and even copayments for those who qualify.

Who Is Eligible?

Eligibility depends on your income and resources. Even if you think you earn too much, it’s worth checking. Many people are surprised to learn they qualify.

Extra Help with Prescription Drugs

Medicare’s Extra Help program provides significant savings for prescription medications. If you’re enrolled, you’ll enjoy lower premiums, deductibles, and copayments on Part D prescription drug plans.

Medicare Advantage: More Than Meets the Eye

Comprehensive Coverage Options

Medicare Advantage plans often include extras like dental, vision, and hearing coverage. While these aren’t standard under Original Medicare, many beneficiaries find them valuable additions to their healthcare.

Integrated Benefits

With Medicare Advantage, you typically have one plan handling your medical and drug coverage. This integration can simplify your healthcare and reduce administrative hassles. Be sure to review your plan’s annual changes to ensure it still meets your needs.

Care for Mental Health and Wellness

Behavioral Health Services

Medicare provides coverage for mental health services, including counseling, therapy, and psychiatric care. Whether you’re dealing with anxiety, depression, or other mental health issues, Medicare has resources to support you.

Annual Wellness Visits

Beyond mental health care, your annual wellness visit is an opportunity to create a personalized prevention plan. This includes cognitive assessments to identify potential risks for conditions like Alzheimer’s.

Telehealth: A Modern Convenience

Expanded Telehealth Services

Medicare has embraced telehealth, offering more services than ever before. These virtual visits let you consult with your healthcare provider from the comfort of your home. Services range from routine check-ups to consultations with specialists.

Cost and Accessibility

Most telehealth services under Medicare cost the same as in-person visits, provided the healthcare provider participates in Medicare. Telehealth can save you time and travel expenses, especially if you live in a rural area.

Maximizing Home Health Benefits

What’s Covered?

Medicare covers a range of home health services for those who qualify, including:

-

Skilled nursing care

-

Physical, occupational, and speech therapy

-

Medical social services

These benefits can be a lifeline if you’re recovering from an illness or injury and need support at home.

Eligibility Requirements

To qualify, your doctor must certify that you’re homebound and in need of intermittent skilled care. Be sure to discuss this option with your healthcare provider.

Hospice Care: Compassionate End-of-Life Support

Comprehensive Care

For those facing terminal illnesses, Medicare’s hospice benefit provides physical, emotional, and spiritual support. This includes pain management, counseling, and respite care for family members.

Financial Relief

Hospice care is typically covered under Medicare Part A with minimal out-of-pocket costs. This ensures that you and your loved ones can focus on comfort and quality of life during a difficult time.

How to Access These Benefits

Know Your Coverage

The first step is understanding what’s available to you. Review your Medicare & You handbook annually and don’t hesitate to ask questions.

Utilize Open Enrollment

Medicare’s Open Enrollment period runs from October 15 to December 7 each year. This is your opportunity to make changes to your coverage, ensuring it aligns with your healthcare needs.

Ask for Help

Navigating Medicare can feel overwhelming, but you don’t have to do it alone. Contact Medicare or a licensed insurance counselor to clarify your options.

Making the Most of Your Medicare Benefits

You pay into Medicare throughout your working life, so why not take full advantage of everything it offers? By exploring these overlooked benefits, you can enhance your healthcare experience, save money, and achieve peace of mind. Don’t wait to unlock the full potential of your Medicare coverage.