Key Takeaways:

- Missing your Medicare enrollment deadline can lead to costly penalties, so it’s essential to understand the various enrollment periods and deadlines.

- Knowing how to avoid late enrollment and its consequences can help you save money and maintain seamless healthcare coverage.

Medicare Enrollment Basics: What Happens If You Miss the Deadline and How to Avoid It

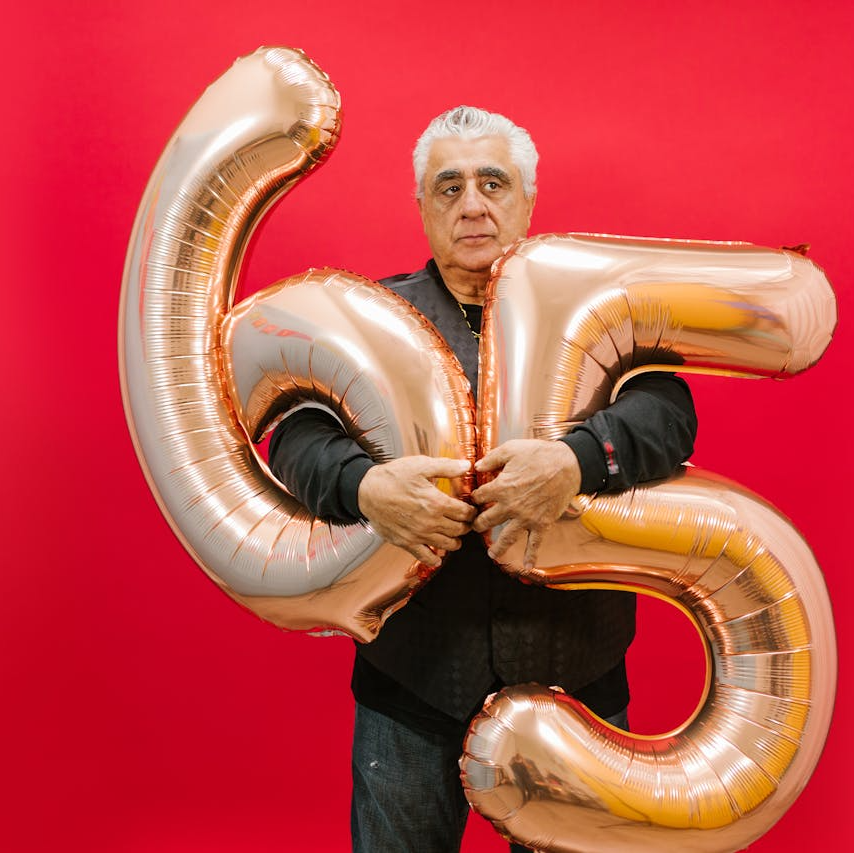

Medicare, a federal health insurance program primarily for people 65 and older, offers critical healthcare coverage that includes hospital stays, doctor visits, and prescription drugs. However, one of the most important aspects of Medicare that often causes confusion is its enrollment process. Understanding the deadlines and consequences of missing them is crucial to maintaining continuous healthcare coverage and avoiding penalties. This guide will explain what happens if you miss a Medicare enrollment deadline, how to prevent that situation, and what to do if you find yourself in this position.

The Different Medicare Enrollment Periods Explained

Medicare has specific windows, known as enrollment periods, during which you can sign up for different parts of the program. Each enrollment period has its own rules, so missing the deadline could have serious implications. Here’s a breakdown of the key enrollment periods:

1. Initial Enrollment Period (IEP)

The Initial Enrollment Period (IEP) is a seven-month window surrounding your 65th birthday. It includes the three months before your birthday month, your birthday month, and the three months after. During this period, you can enroll in Medicare Part A (hospital insurance) and Part B (medical insurance) without incurring any penalties. If you delay signing up for Medicare Part B during this period without having other creditable coverage, you may face lifelong penalties.

2. General Enrollment Period (GEP)

If you miss your Initial Enrollment Period, the next opportunity to enroll is during the General Enrollment Period (GEP). The GEP runs from January 1 to March 31 each year, with coverage beginning on July 1. However, enrolling during this time often comes with financial penalties. If you didn’t sign up during your IEP and don’t have qualifying health insurance coverage, you’ll likely pay higher premiums for Medicare Part B and Part D, the prescription drug coverage.

3. Special Enrollment Period (SEP)

For some people, life circumstances might allow them to enroll in Medicare outside of the Initial and General Enrollment Periods. If you have group health coverage through your job or your spouse’s employment when you turn 65, you might qualify for a Special Enrollment Period (SEP). This window allows you to sign up for Medicare without facing penalties once your employer-sponsored insurance ends. The SEP typically lasts for eight months after your employment or coverage ends.

What Happens If You Miss the Medicare Enrollment Deadline?

Missing a Medicare enrollment deadline can have financial and healthcare-related consequences. Here’s a closer look at what could happen:

1. Late Enrollment Penalties

One of the most significant issues with missing a Medicare deadline is the late enrollment penalty. These penalties apply to both Medicare Part B and Part D and can last a lifetime.

-

Medicare Part B Penalty: If you don’t sign up for Part B during your Initial Enrollment Period, you could pay a penalty that increases your premiums by 10% for every 12-month period you delayed enrollment. This penalty is added to your monthly premium for as long as you have Part B.

-

Medicare Part D Penalty: Medicare Part D helps cover prescription drugs. If you go 63 days or more without Part D or other creditable prescription drug coverage after your IEP, you’ll be subject to a late enrollment penalty. This penalty is calculated based on how long you went without coverage and is added to your Part D premium for as long as you have coverage.

2. Gaps in Healthcare Coverage

Missing an enrollment deadline can also lead to gaps in your healthcare coverage. If you don’t enroll in time and have no other health insurance, you could be left without essential medical coverage until the next enrollment window opens. This gap could lead to unexpected out-of-pocket costs for medical services that Medicare would have covered.

3. Limited Access to Plans

If you miss a deadline, you might also face limited plan options during the next enrollment period. Certain Medicare Advantage or Part D plans may not be available outside of specific periods, reducing your choices for coverage.

How to Avoid Missing Medicare Enrollment Deadlines

The good news is that you can take steps to avoid missing Medicare deadlines and the consequences that come with them. Here are practical tips to help you stay on track:

1. Mark Key Dates in Your Calendar

One of the simplest ways to avoid missing your Medicare enrollment deadline is by marking the important dates in your calendar. Be sure to note when your Initial Enrollment Period begins and ends, and set reminders for the General Enrollment Period and Special Enrollment Periods if they apply to you.

2. Understand Your Current Coverage

If you’re still working or have health coverage through a spouse, it’s essential to know how this insurance interacts with Medicare. Employer-sponsored plans often allow you to delay Medicare enrollment without penalties, but the rules can vary. Double-check with your benefits coordinator or a licensed insurance agent to ensure you don’t miss key deadlines.

3. Sign Up Early

Even though the Initial Enrollment Period lasts seven months, signing up as soon as possible ensures that your coverage begins when you turn 65. This can prevent any gaps in coverage or penalties. You can sign up for Medicare online or by contacting Social Security.

4. Set Reminders for the General and Special Enrollment Periods

If you missed your Initial Enrollment Period, don’t panic. Mark the dates for the General Enrollment Period on your calendar, and explore whether you qualify for a Special Enrollment Period. In addition, keep records of your health coverage to prove you had creditable insurance if needed.

5. Seek Professional Guidance

Navigating Medicare can be overwhelming, especially with the penalties and deadlines involved. Consider seeking guidance from a licensed insurance agent who can help you understand your options and ensure you meet the necessary enrollment deadlines.

Steps to Take If You’ve Already Missed a Deadline

If you’ve missed a Medicare enrollment deadline, you’re not alone—many people overlook these critical dates. However, there are steps you can take to minimize the impact.

1. Enroll as Soon as Possible

If you’ve missed your Initial Enrollment Period, sign up during the General Enrollment Period to avoid further delays. While you may face penalties, enrolling as soon as possible will minimize gaps in coverage and prevent future issues.

2. File for a Special Enrollment Period

If you believe you qualify for a Special Enrollment Period, gather the necessary documentation and apply as soon as your circumstances allow. This could help you avoid penalties and maintain your coverage without interruptions.

3. Appeal the Late Enrollment Penalty

In some cases, you may be able to appeal the late enrollment penalty if you missed the deadline due to incorrect information or an extenuating circumstance. Contact Medicare or a licensed insurance agent to explore your options.

Planning Ahead to Secure Your Medicare Benefits

Being proactive about Medicare enrollment is essential to ensure seamless healthcare coverage during retirement. By understanding the different enrollment periods, staying organized with your dates, and taking early action, you can avoid costly penalties and gaps in coverage. Don’t wait until it’s too late—start planning now to secure the healthcare coverage you need in your golden years.

Stay Covered and Avoid Penalties

Missing Medicare enrollment deadlines can result in hefty penalties and disruptions in your healthcare coverage. The good news is that with proper planning, these issues are avoidable. By keeping track of important dates, understanding your eligibility for Special Enrollment Periods, and seeking professional guidance, you can navigate the Medicare system with confidence and stay covered without incurring unnecessary costs.

Contact Information:

Email: [email protected]

Phone: 6615550123