Key Takeaways

- Medicare Part A provides essential hospital insurance coverage for inpatient care, skilled nursing facilities, hospice care, and some home health services.

- Understanding the specific coverage, costs, and eligibility criteria of Medicare Part A is crucial for making informed healthcare decisions.

Medicare Part A Hospital Insurance: Key Coverage Points

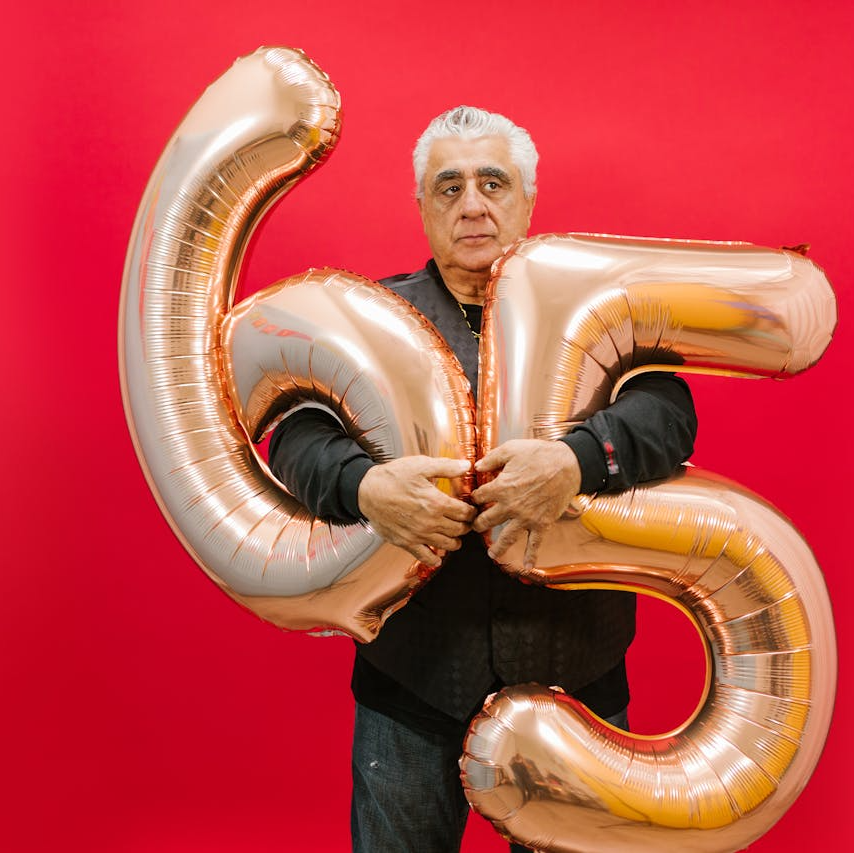

Medicare Part A is a fundamental component of the Medicare program, providing hospital insurance coverage to millions of Americans, primarily those aged 65 and older. This essential coverage also extends to certain younger individuals with disabilities and those with End-Stage Renal Disease (ESRD) or Amyotrophic Lateral Sclerosis (ALS). Understanding the key coverage points of Medicare Part A is crucial for beneficiaries to make informed decisions about their healthcare needs. This article explores the scope of Medicare Part A, including what it covers, costs associated with the coverage, and eligibility criteria.

What Medicare Part A Covers

Medicare Part A primarily focuses on inpatient hospital care but also includes other critical healthcare services. Here’s a detailed look at what is covered under Medicare Part A:

Inpatient Hospital Care

Medicare Part A covers inpatient hospital care, which includes:

- Semi-private rooms: A shared room with another patient.

- Meals: Hospital-provided meals during your stay.

- General nursing: Routine nursing care provided by hospital staff.

- Drugs: Medications administered during your inpatient stay.

- Other hospital services and supplies: Operating room costs, lab tests, X-rays, and medical equipment used during your stay.

Coverage begins on the day you are formally admitted to the hospital and ends when you have not received any inpatient care for 60 days in a row.

Costs Associated with Inpatient Hospital Care

- Deductible: In 2024, the deductible for each benefit period is $1,632.

- Coinsurance:

- $0 for the first 60 days of each benefit period.

- $400 per day for days 61-90 of each benefit period.

- $800 per “lifetime reserve day” after day 90 of each benefit period (up to 60 days over your lifetime).

Skilled Nursing Facility (SNF) Care

Medicare Part A covers skilled nursing facility care for a limited time under specific conditions:

- Skilled nursing care: Includes services provided by trained nurses or rehabilitation staff, such as physical therapy, occupational therapy, and speech-language pathology services.

- Semi-private room: A shared room with another patient.

- Meals: Meals provided by the facility.

- Medical supplies and equipment: Items such as wound dressings, IV supplies, and other necessary medical supplies.

Conditions for SNF Coverage

To qualify for Medicare-covered SNF care, the following conditions must be met:

- Prior hospital stay: You must have had an inpatient hospital stay of at least three days.

- Doctor’s order: Your doctor must order skilled nursing care for a condition treated during the hospital stay or for a condition that started while receiving care in the SNF.

- Medicare-approved facility: The SNF must be Medicare-certified.

Costs Associated with SNF Care

- Coinsurance:

- $0 for the first 20 days of each benefit period.

- $200 per day for days 21-100 of each benefit period.

- All costs for each day after day 100 of the benefit period.

Hospice Care

Medicare Part A covers hospice care for terminally ill patients who choose to focus on comfort and quality of life rather than curative treatment. Hospice care includes:

- Medical services: Provided by doctors and nurses specializing in palliative care.

- Prescription drugs: Pain relief and symptom management medications.

- Durable medical equipment: Items such as wheelchairs and hospital beds.

- Counseling services: Support for patients and their families.

- Respite care: Temporary relief for caregivers, allowing them a break while the patient is cared for in a Medicare-approved facility.

Conditions for Hospice Care Coverage

- Doctor’s certification: Two doctors must certify that the patient is terminally ill with a life expectancy of six months or less.

- Electing hospice care: The patient must choose hospice care over curative treatments for their terminal illness.

- Medicare-approved hospice program: Care must be received from a Medicare-approved hospice program.

Costs Associated with Hospice Care

- Copayment: $0 for hospice care services, but a copayment of up to $5 may apply for prescription drugs and other similar products for symptom control and pain relief.

- Respite care: You may pay 5% of the Medicare-approved amount for inpatient respite care.

Home Health Care

Medicare Part A covers certain home health care services if you meet specific conditions. Covered services include:

- Skilled nursing care: Intermittent (and not full-time) care provided by a registered nurse.

- Therapy services: Physical therapy, speech-language pathology, and occupational therapy.

- Medical social services: Counseling and social work services.

- Medical supplies: Necessary medical supplies provided at home, such as wound care items.

Conditions for Home Health Care Coverage

- Doctor’s orders: A doctor must certify that you need skilled nursing care or therapy services.

- Homebound status: You must be homebound, meaning leaving home requires considerable effort and assistance.

- Medicare-approved home health agency: The care must be provided by a Medicare-certified home health agency.

Costs Associated with Home Health Care

- Coinsurance: $0 for home health care services.

- Durable medical equipment: You pay 20% of the Medicare-approved amount.

Eligibility for Medicare Part A

To qualify for Medicare Part A, you must meet specific eligibility criteria, primarily based on age, disability status, or certain health conditions.

Age-Based Eligibility

- Age 65 or older: You qualify for Medicare Part A if you are 65 or older and a U.S. citizen or permanent legal resident for at least five continuous years.

- Work history: You or your spouse must have worked and paid Medicare taxes for at least 10 years (40 quarters).

Disability-Based Eligibility

- Social Security Disability Insurance (SSDI): You are eligible for Medicare Part A if you have been receiving SSDI benefits for at least 24 months.

- ALS (Amyotrophic Lateral Sclerosis): You qualify for Medicare immediately upon receiving SSDI benefits due to ALS.

Specific Health Conditions

- End-Stage Renal Disease (ESRD): Individuals with ESRD requiring dialysis or a kidney transplant are eligible for Medicare Part A. Coverage typically begins the first month of dialysis if the patient meets certain conditions or upon receiving a kidney transplant.

Conclusion

Medicare Part A is a vital part of the healthcare coverage for millions of Americans, providing essential hospital insurance for inpatient care, skilled nursing facilities, hospice care, and some home health services. Understanding the specifics of what Medicare Part A covers, the associated costs, and the eligibility criteria can help beneficiaries make informed decisions about their healthcare needs. By familiarizing yourself with these key coverage points, you can ensure that you maximize the benefits available to you under Medicare Part A and receive the necessary care without undue financial burden.

Contact Information:

Email: [email protected]

Phone: 6615550123