Key Takeaways

- Understanding various Medicare options can help low-income seniors find the most affordable and suitable healthcare coverage.

- Leveraging available financial assistance programs can significantly reduce out-of-pocket costs for Medicare beneficiaries.

Choosing the Right Plan: Medicare Options for Low-Income Seniors

Navigating the landscape of Medicare options can be challenging, particularly for low-income seniors who need to find affordable and comprehensive healthcare coverage. Selecting the right Medicare plan involves understanding the various parts of Medicare, the additional assistance programs available, and the specific needs of the individual. This guide provides an in-depth look at Medicare options for low-income seniors and offers practical advice on choosing the right plan.

Understanding Medicare Parts and Plans

Medicare is divided into several parts, each covering different aspects of healthcare:

Medicare Part A (Hospital Insurance)

Medicare Part A covers inpatient hospital stays, skilled nursing facility care, hospice care, and some home health care. For most people, Part A is premium-free if they or their spouse paid Medicare taxes while working. However, there may be deductibles and coinsurance costs associated with these services.

Medicare Part B (Medical Insurance)

Medicare Part B covers outpatient care, doctor visits, preventive services, and durable medical equipment. Part B requires a monthly premium, which can be a significant expense for low-income seniors. Additionally, there are annual deductibles and coinsurance costs.

Medicare Part C (Medicare Advantage)

Medicare Advantage Plans, also known as Part C, are offered by private insurance companies approved by Medicare. These plans provide all Part A and Part B benefits and often include additional coverage such as vision, dental, and hearing services. Some plans also offer prescription drug coverage (Part D). Medicare Advantage Plans typically have lower out-of-pocket costs and can be an affordable option for low-income seniors.

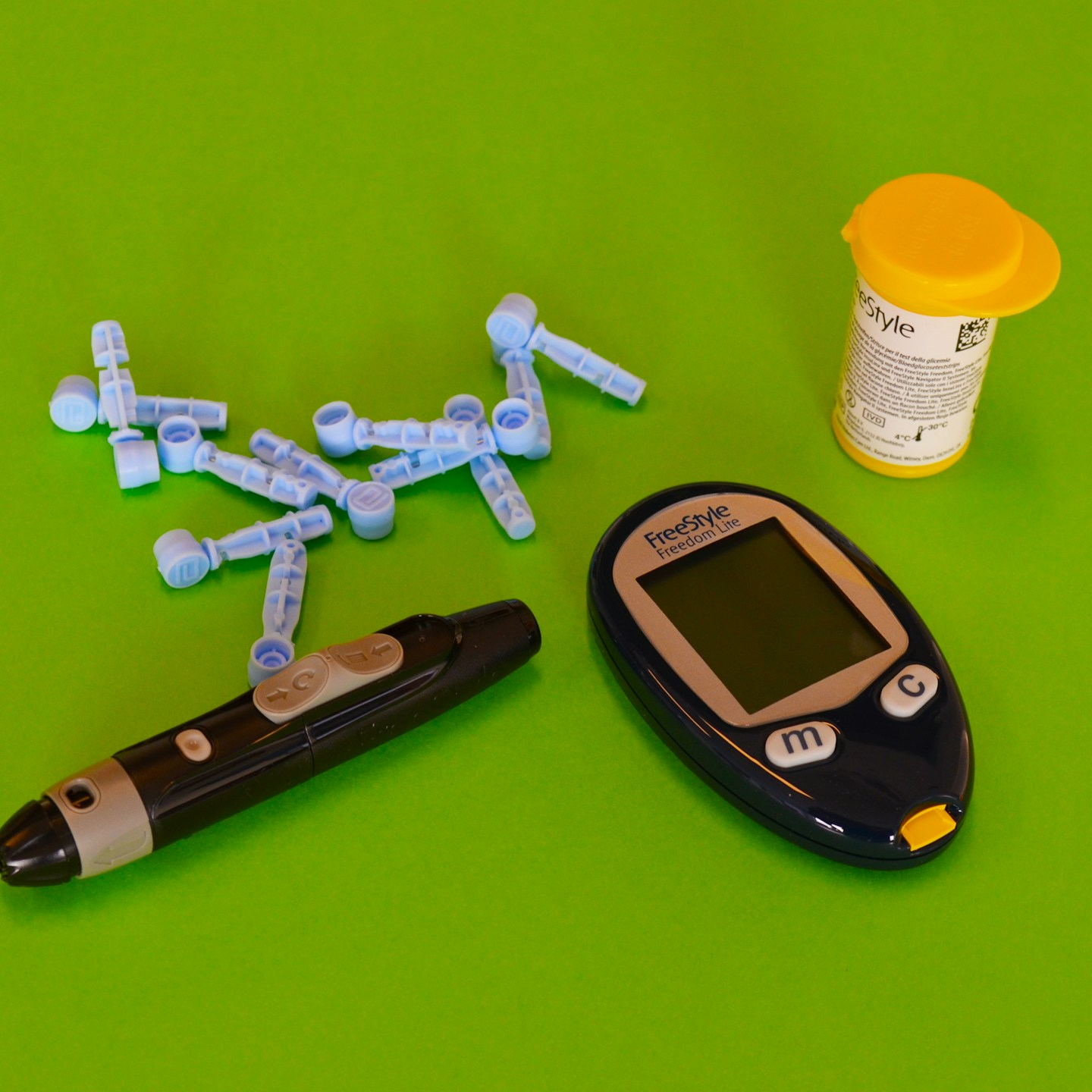

Medicare Part D (Prescription Drug Coverage)

Medicare Part D provides coverage for prescription medications. These plans are offered by private insurance companies and vary in terms of the drugs covered, premiums, and out-of-pocket costs. For low-income seniors, the cost of prescription drugs can be a significant burden, making Part D an essential part of their healthcare coverage.

Medigap (Medicare Supplement Insurance)

Medigap policies are sold by private insurance companies and help cover the out-of-pocket costs associated with Original Medicare (Parts A and B), such as copayments, coinsurance, and deductibles. Medigap can be beneficial for low-income seniors who prefer Original Medicare but need help managing their expenses. However, Medigap policies require a monthly premium, which may be prohibitive for some low-income individuals.

Financial Assistance Programs for Low-Income Seniors

Several programs are available to help low-income seniors manage their Medicare costs:

Medicaid

Medicaid is a state and federal program that provides health coverage for low-income individuals, including seniors. Medicaid can work alongside Medicare to cover costs that Medicare does not, such as long-term care, personal care services, and additional medical expenses. Eligibility for Medicaid varies by state, but it generally depends on income and asset limits.

Medicare Savings Programs (MSPs)

Medicare Savings Programs help pay for Medicare premiums, deductibles, coinsurance, and copayments. There are four types of MSPs, each with different income and asset limits:

- Qualified Medicare Beneficiary (QMB) Program: Helps pay for Part A and Part B premiums, deductibles, coinsurance, and copayments.

- Specified Low-Income Medicare Beneficiary (SLMB) Program: Helps pay for Part B premiums.

- Qualifying Individual (QI) Program: Also helps pay for Part B premiums, but funds are limited and applications are approved on a first-come, first-served basis.

- Qualified Disabled and Working Individuals (QDWI) Program: Helps pay for Part A premiums for certain disabled individuals who are working.

Extra Help (Low-Income Subsidy)

The Extra Help program assists with the cost of Medicare Part D prescription drug coverage. This program can significantly reduce premiums, deductibles, and copayments for prescription medications. Eligibility for Extra Help is based on income and asset limits, and those who qualify are automatically enrolled in a Part D plan if they are not already enrolled.

State Pharmaceutical Assistance Programs (SPAPs)

Many states offer SPAPs to help residents with the cost of prescription drugs. These programs vary by state in terms of eligibility, benefits, and coverage. SPAPs can work alongside Medicare Part D to provide additional assistance with medication costs.

Choosing the Right Medicare Plan

Selecting the right Medicare plan requires careful consideration of individual healthcare needs, financial situation, and available assistance programs. Here are some steps to help low-income seniors choose the best plan:

Assess Healthcare Needs

Understanding personal healthcare needs is the first step in selecting the right Medicare plan. Consider the following factors:

- Frequency of doctor visits: Do you need regular visits to specialists or frequent medical check-ups?

- Prescription medications: What medications do you take regularly, and are they covered by the plan?

- Chronic conditions: Do you have any chronic conditions that require ongoing treatment or specialized care?

- Additional services: Do you need coverage for vision, dental, or hearing services?

Compare Medicare Advantage and Original Medicare

For low-income seniors, Medicare Advantage Plans can offer comprehensive coverage with lower out-of-pocket costs compared to Original Medicare. These plans often include additional benefits such as prescription drug coverage and routine vision and dental care. However, it is essential to compare the specific benefits, costs, and provider networks of Medicare Advantage Plans available in your area.

Consider Medigap Policies

If you prefer Original Medicare, a Medigap policy can help cover out-of-pocket costs. Compare different Medigap policies to find one that fits your budget and healthcare needs. Keep in mind that Medigap policies require a monthly premium, which may be challenging for low-income seniors.

Utilize Financial Assistance Programs

Take advantage of financial assistance programs such as Medicaid, Medicare Savings Programs, Extra Help, and State Pharmaceutical Assistance Programs. These programs can significantly reduce your healthcare costs and make Medicare more affordable. Contact your state Medicaid office or a local SHIP counselor for assistance with applying for these programs.

Use the Medicare Plan Finder

The Medicare Plan Finder is an online tool that allows you to compare Medicare plans based on your location, healthcare needs, and financial situation. This tool provides detailed information on plan benefits, costs, and provider networks, helping you make an informed decision.

Seek Personalized Counseling

State Health Insurance Assistance Programs (SHIPs) offer free, personalized counseling to Medicare beneficiaries. SHIP counselors can help you understand your Medicare options, compare plans, and apply for financial assistance programs. Contact your local SHIP office to schedule a counseling session.

Conclusion: Making Informed Decisions for Better Healthcare

Choosing the right Medicare plan is crucial for low-income seniors to ensure access to affordable and comprehensive healthcare. By understanding the various parts of Medicare, exploring financial assistance programs, and utilizing available resources, seniors can make informed decisions that best meet their healthcare needs and financial situation. Remember to assess your healthcare needs, compare plan options, and seek personalized counseling to navigate the complexities of Medicare and find the best plan for you.

Contact Information:

Email: [email protected]

Phone: 4055551234