Key Takeaways

- Medicare Advantage and Medicare Supplement plans provide different benefits, so understanding both options is crucial to choosing the right one.

- Weigh the pros and cons of each option to find the coverage that best suits your medical and financial needs.

Everything You Need to Know About Medicare Advantage and Medicare Supplement Before Making a Decision

Making the right decision between Medicare Advantage and Medicare Supplement plans can have a lasting impact on your healthcare experience. These two options offer distinct coverage approaches, and it’s important to carefully evaluate each based on your unique medical and financial needs. Understanding how these plans work will help you navigate the complexities of Medicare, making sure you get the most out of your coverage.

What is Medicare Advantage?

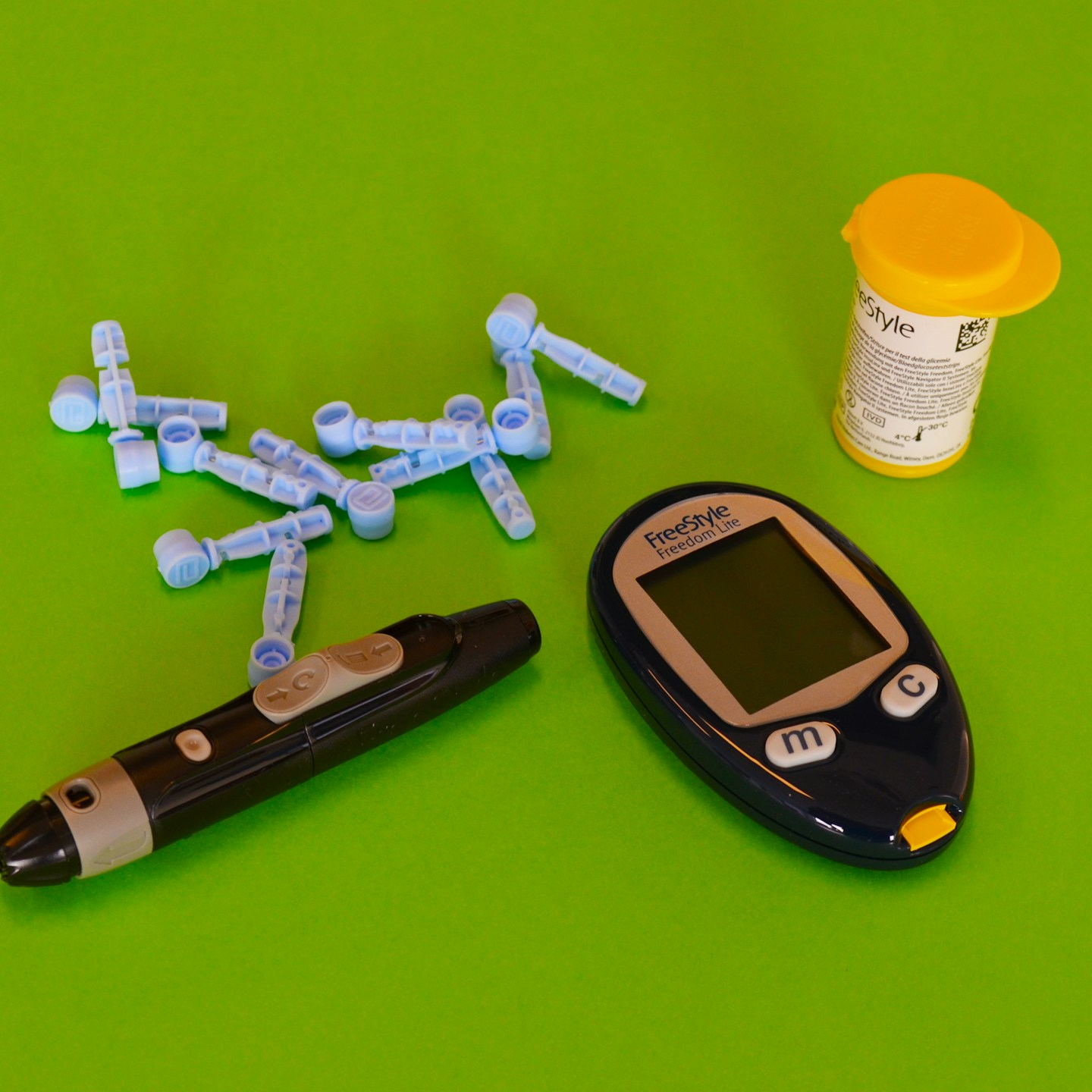

Medicare Advantage, also known as Medicare Part C, is an alternative to Original Medicare that provides bundled coverage. It combines hospital (Part A) and medical (Part B) coverage, often with additional benefits not included in Original Medicare, such as vision, dental, and hearing services. Many Medicare Advantage plans also offer prescription drug coverage (Part D), making them a more comprehensive option in terms of included services.

However, Medicare Advantage operates through private insurance companies, which means plan availability, covered services, and costs vary depending on where you live. These plans typically have networks of healthcare providers, and you may need to get care within the plan’s network to avoid higher out-of-pocket costs.

Key Benefits of Medicare Advantage

- All-in-one coverage: Medicare Advantage plans often provide comprehensive healthcare services, including vision, dental, and prescription drugs.

- Additional benefits: Some plans may offer wellness programs or transportation for medical visits, making them more convenient for people with specific health needs.

- Cost predictability: Some Medicare Advantage plans have out-of-pocket limits, meaning once you spend a certain amount on covered services in a year, the plan pays 100% of your remaining healthcare costs.

Potential Downsides of Medicare Advantage

- Network restrictions: Many Medicare Advantage plans have limited networks of doctors and hospitals, which could restrict your options when seeking care.

- Referral requirements: Depending on the plan, you may need a referral to see a specialist, adding extra steps in managing your healthcare.

- Location-based coverage: Because these plans vary by location, moving to a different area could impact your coverage or even require switching plans.

What is Medicare Supplement (Medigap)?

Medicare Supplement, also called Medigap, is designed to work alongside Original Medicare by covering some of the out-of-pocket costs that Original Medicare doesn’t, such as copayments, coinsurance, and deductibles. These plans don’t offer additional services like dental or vision, but they can help reduce financial uncertainty by covering gaps in Original Medicare.

Unlike Medicare Advantage, Medigap policies are standardized and regulated, meaning that benefits are consistent regardless of which private insurance company you purchase them from. You also won’t have network restrictions, giving you access to any healthcare provider that accepts Medicare.

Key Benefits of Medicare Supplement

- Standardized coverage: Medigap policies are standardized, meaning the same plan provides the same benefits no matter where you purchase it.

- Nationwide provider access: With Medicare Supplement, you can see any doctor or specialist that accepts Medicare without worrying about network restrictions.

- Reduced financial stress: By covering out-of-pocket expenses like deductibles and copayments, Medicare Supplement can make healthcare costs more predictable.

Potential Downsides of Medicare Supplement

- No additional services: Medigap does not cover additional benefits like vision, dental, or prescription drugs, so you may need separate plans to cover these needs.

- Higher premiums: Medicare Supplement plans typically have higher monthly premiums compared to Medicare Advantage plans, which may not fit all budgets.

- No coverage for non-Medicare services: Medigap only covers services that are included in Original Medicare, so it won’t help with costs like routine vision or hearing exams.

Key Differences Between Medicare Advantage and Medicare Supplement

While both Medicare Advantage and Medicare Supplement plans serve to enhance your healthcare coverage, they do so in very different ways. Understanding these differences is critical to choosing the best option for you.

Plan Structure

Medicare Advantage replaces Original Medicare with an all-in-one plan that includes additional services. It is a self-contained system with networks, potentially restrictive care options, and added benefits. On the other hand, Medicare Supplement works alongside Original Medicare, simply covering gaps in the standard Medicare coverage. You retain your Original Medicare benefits while adding financial protection against out-of-pocket costs.

Coverage Options

Medicare Advantage plans may offer more robust coverage options, such as vision and dental care, all within one plan. They also frequently include prescription drug coverage, meaning you won’t need a separate plan for medications. Medicare Supplement, by contrast, focuses solely on covering what Original Medicare does not. If you need prescription drug coverage or other additional services, you would need to purchase separate plans.

Costs and Networks

Medicare Advantage plans often have lower premiums but come with network restrictions, meaning you may be limited in which doctors or hospitals you can use. You may also face out-of-pocket costs for care outside of the network. Medicare Supplement plans typically have higher premiums but offer greater flexibility, allowing you to see any provider that accepts Medicare without worrying about networks.

How to Decide Which Plan is Right for You

When choosing between Medicare Advantage and Medicare Supplement, it’s essential to consider your personal healthcare needs, financial situation, and future plans. Here are some key questions to ask yourself when deciding:

-

How often do I need medical care?

- If you frequently visit doctors, hospitals, or specialists, a Medicare Supplement plan might help reduce your out-of-pocket costs. However, if you only need occasional care, the comprehensive coverage of a Medicare Advantage plan may suffice.

-

Do I need additional services like vision, dental, or prescription drug coverage?

- Medicare Advantage may be the better option if you want all of your healthcare services covered under one plan. On the other hand, if you’re comfortable purchasing separate plans for prescription drugs and other services, a Medicare Supplement plan could work well.

-

Do I travel frequently?

- Medicare Supplement plans offer nationwide coverage, which is ideal if you travel often and need healthcare flexibility across states. Medicare Advantage plans, by contrast, may restrict coverage to a specific geographic area or network of providers.

-

What is my budget?

- Medicare Advantage plans often have lower premiums and additional benefits, making them more budget-friendly upfront. However, Medicare Supplement plans can reduce your long-term costs by covering out-of-pocket expenses, especially if you have frequent medical needs.

Should You Switch Plans?

If you’re already enrolled in Medicare Advantage or Medicare Supplement and are considering switching, it’s important to carefully review your current coverage before making a decision. Certain life changes, such as moving to a different state, can affect your coverage or network availability. Additionally, healthcare needs can change over time, making a different type of coverage more beneficial.

Consider the Timing

Open Enrollment periods are a crucial time to evaluate your healthcare coverage options. Whether you’re considering switching from Medicare Advantage to Medicare Supplement or vice versa, it’s important to check your eligibility and understand how switching plans might affect your healthcare access and costs.

Review Your Healthcare Needs

Think about how often you visit healthcare providers and what types of care you use. If your current plan no longer meets your needs, it may be time to switch. Consulting a licensed insurance agent can help you navigate the complexities and ensure you make an informed choice.

Weighing Your Options

Deciding between Medicare Advantage and Medicare Supplement requires careful consideration of both your current and future healthcare needs. Each option has distinct advantages, and understanding the trade-offs between comprehensive coverage and flexible networks is key. Take the time to assess your priorities and financial situation before making a final decision.

A Broader Look at Medicare Coverage Options

As you evaluate Medicare Advantage and Medicare Supplement plans, remember that the best choice depends on your unique situation. Both options offer valuable benefits, but they serve different purposes in your healthcare strategy. Be sure to explore all your options, and don’t hesitate to reach out to a licensed insurance agent for personalized advice.

Contact Information:

Email: [email protected]

Phone: 4055551234