Key Takeaways

-

In 2025, the Medicare Income-Related Monthly Adjustment Amount (IRMAA) thresholds are higher, but so are the surcharge amounts—many retirees are now paying more than they expected.

-

Your Medicare premiums in 2025 are still based on your Modified Adjusted Gross Income (MAGI) from your 2023 tax return, which may not reflect your current financial situation.

The Quiet Climb in Medicare Costs for Higher-Income Retirees

If you’re enrolled in Medicare, you probably know that your costs include more than just premiums and deductibles. What surprises many retirees, however, is the income-related surcharge that can dramatically increase what you owe for Medicare Part B and Part D. This surcharge, known as IRMAA (Income-Related Monthly Adjustment Amount), has risen again in 2025—and it’s catching many people off guard.

IRMAA is based on income you reported two years ago. So, in 2025, Medicare uses your 2023 tax return to determine if you owe the surcharge. That lag in income evaluation means even if your income has dropped recently—due to retirement, loss of investment income, or other changes—you might still be paying the higher premium.

How IRMAA Works in 2025

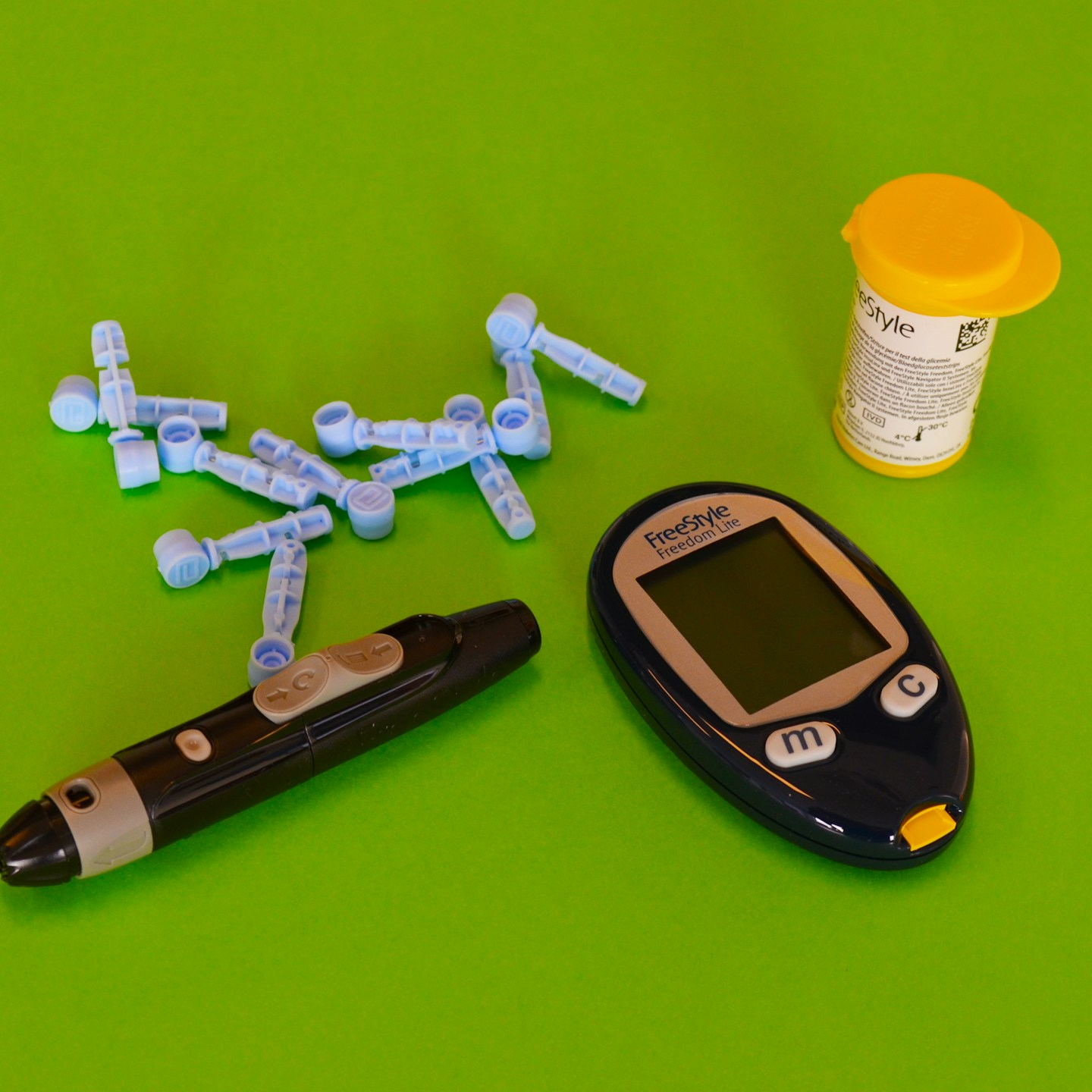

The standard monthly premium for Medicare Part B in 2025 is $185. But if your 2023 MAGI exceeds a certain threshold, IRMAA adds a surcharge to that base premium. The same applies to Medicare Part D prescription drug coverage. While premiums for Part D vary depending on your plan, IRMAA adds a fixed surcharge on top of it.

Here are the basics of how it’s applied:

-

The surcharge begins once your MAGI exceeds $103,000 (individuals) or $206,000 (joint filers).

-

There are five income brackets above the threshold, with increasing surcharges.

-

IRMAA can raise your monthly Medicare Part B premium by hundreds of dollars.

This means retirees who aren’t monitoring their income—or who have a one-time spike—can find themselves in a much higher payment bracket for the entire year.

Why You Might Not See It Coming

One of the most frustrating aspects of IRMAA is how subtle the trigger can be. Many retirees assume that once they’ve stopped working, their Medicare premiums will settle down. But that’s not always true.

You might get hit with an IRMAA surcharge if:

-

You sell property and realize a large capital gain.

-

You convert a traditional IRA to a Roth IRA.

-

You take a one-time large distribution from retirement accounts.

-

You receive an unexpected bonus or inheritance.

These aren’t recurring income sources, but they still count as income for IRMAA purposes. Because the surcharge is recalculated annually based on income from two years prior, a single high-income year can lead to higher Medicare costs for 12 full months.

MAGI: The Income That Matters

Medicare uses a specific calculation of income called Modified Adjusted Gross Income (MAGI). This is your Adjusted Gross Income (AGI) plus:

-

Tax-exempt interest income

-

Foreign earned income excluded from taxes

-

Income from U.S. savings bonds used to pay for higher education

If you aren’t keeping track of your MAGI, you might assume your income is lower than it actually is. That misunderstanding could leave you vulnerable to surprise IRMAA bills.

What You Can Do If You’re Hit by IRMAA

If your income was temporarily high in 2023 but has dropped in 2025, there are steps you can take.

1. File a Request for Reconsideration

Medicare allows you to challenge your IRMAA determination if your income has dropped due to certain life-changing events. These include:

-

Retirement

-

Loss of pension

-

Divorce or death of a spouse

-

Involuntary loss of income-producing property

-

Work reduction

You’ll need to file Form SSA-44 with the Social Security Administration and provide supporting documents. If approved, your surcharge can be adjusted to reflect your current income instead of your 2023 MAGI.

2. Time Your Income Strategically

Because Medicare uses tax returns from two years prior, planning your income today affects your premiums in the future. Consider:

-

Spreading Roth conversions over several years instead of doing them all at once.

-

Selling investments gradually rather than taking all capital gains in one year.

-

Delaying large IRA withdrawals until a year when your income is lower.

3. Watch for Recurring Mistakes

Some retirees are caught off guard because they didn’t realize that certain income counts toward IRMAA. For example:

-

Required Minimum Distributions (RMDs) from traditional retirement accounts

-

Severance payments

-

Unemployment income

Understanding what counts in your MAGI calculation is key to staying below IRMAA thresholds.

How IRMAA Affects Couples

Married couples filing jointly face a higher threshold before IRMAA kicks in—$206,000 in 2025—but their combined income makes it easier to exceed that number. If only one spouse is on Medicare, the surcharge still applies based on the joint income.

This can lead to confusion, especially if the Medicare-enrolled spouse has little personal income. It doesn’t matter—Medicare looks at the household’s joint income.

Divorced or recently widowed retirees may also experience unexpected changes. If your filing status changes, your MAGI bracket for IRMAA purposes could change dramatically, affecting your premium.

IRMAA for Part D: A Separate Surcharge

Even if you choose a low-cost Part D plan, IRMAA can increase your total drug coverage cost substantially. In 2025, the surcharge for Part D also follows a five-tier structure, with higher-income retirees paying a monthly amount directly to Medicare, not to the plan provider.

You must pay this IRMAA surcharge even if your plan premium is deducted from your Social Security check. If you fail to pay it on time, you risk losing your Part D coverage entirely.

Social Security Withholding and Payment Confusion

If you receive Social Security benefits, your Medicare Part B and IRMAA surcharges are typically withheld from your monthly benefit. But if your benefit isn’t high enough to cover the premium and IRMAA, you’ll receive a bill from Medicare instead.

This often surprises new retirees. They expect Medicare costs to be handled automatically, but they may suddenly be responsible for quarterly premium payments they weren’t budgeting for.

IRMAA Surcharges Don’t Last Forever

The good news? If your income falls and stays below the threshold, your surcharge will eventually be removed. Medicare re-evaluates your IRMAA level each year based on your latest available tax return.

So if your 2024 income was lower than 2023’s, your premiums may drop in 2026. Until then, the surcharge remains.

Planning Ahead to Avoid Costly Surprises

Avoiding IRMAA completely might not be possible—especially if you’ve saved and invested wisely over your lifetime. But you can still reduce its impact by staying informed and planning strategically.

Meet with a financial advisor who understands IRMAA and Medicare.

Use tax-efficient withdrawal strategies to keep your MAGI lower.

And most importantly, be proactive. A little planning today can reduce your Medicare costs in the years to come.

Protecting Yourself From Medicare Surcharge Shocks

IRMAA is one of the least understood—and most expensive—parts of Medicare. But it doesn’t have to derail your retirement budget. Understanding how your income affects your premiums is the first step toward managing those costs.

If you’re unsure about how IRMAA applies to your situation, speak with a licensed agent listed on this website. They can walk you through the thresholds, filing options, and strategies to help keep your Medicare premiums under control.