Key Takeaways

-

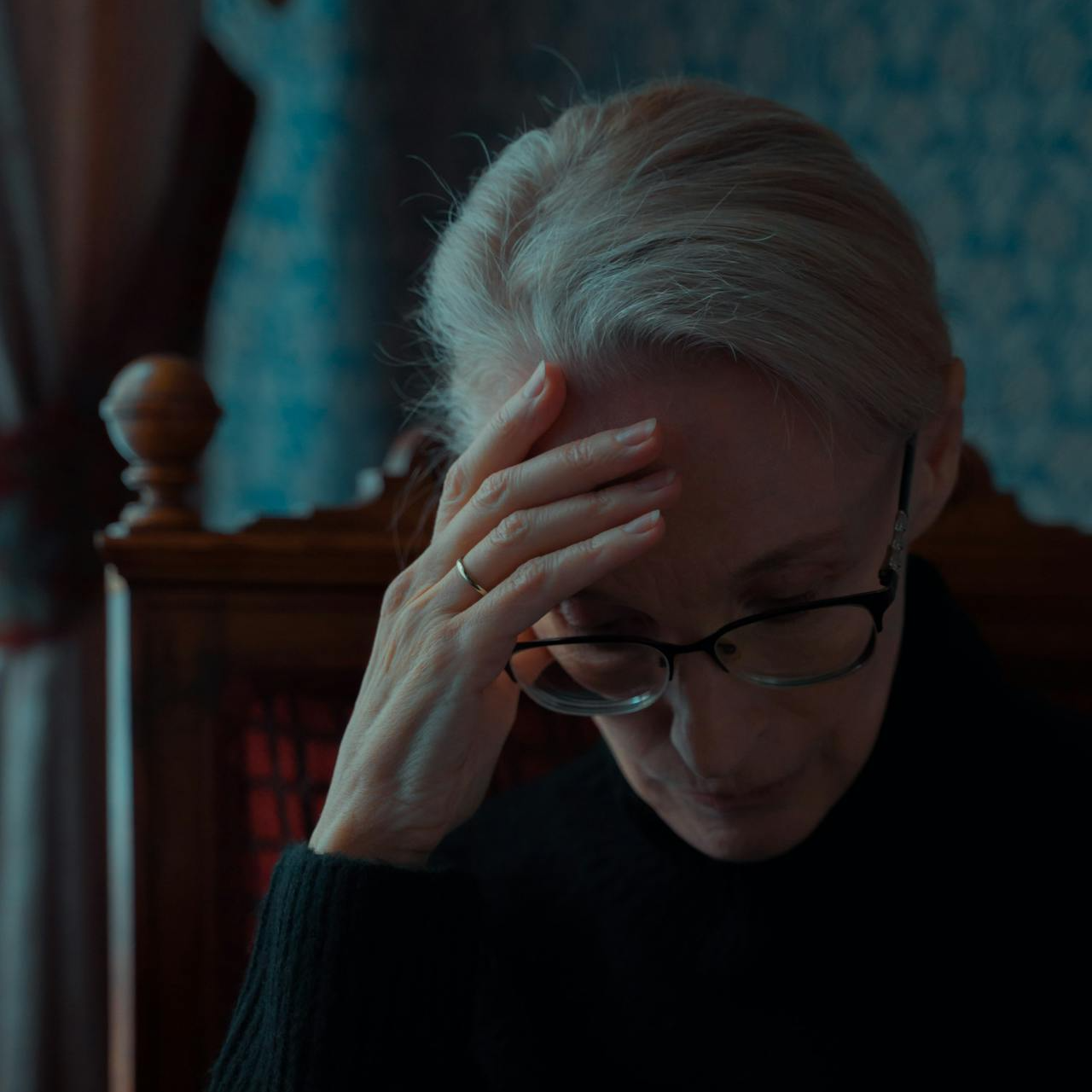

Understanding Medicare eligibility is essential before applying to avoid costly mistakes and coverage gaps.

-

Knowing your age, work history, and health status can determine when and how you should enroll.

Are You the Right Age to Enroll in Medicare?

Age is one of the most critical factors in Medicare eligibility. The standard age to qualify for Medicare is 65. Your Initial Enrollment Period (IEP) begins three months before your 65th birthday and lasts for seven months. If you miss this window, you may face penalties and delays in coverage.

If you’re younger than 65, you might still qualify for Medicare if you have a qualifying disability and have received Social Security Disability Insurance (SSDI) for at least 24 months. Additionally, individuals diagnosed with End-Stage Renal Disease (ESRD) or Amyotrophic Lateral Sclerosis (ALS) can qualify at any age without waiting periods.

Do You Have Enough Work Credits for Premium-Free Part A?

Medicare Part A, which covers hospital services, is generally premium-free if you or your spouse worked and paid Medicare taxes for at least 10 years (40 quarters). If you don’t have enough work history, you can still buy into Part A by paying a monthly premium. In 2025, the Part A premium is $518 per month if you have fewer than 30 work credits, and $284 per month if you have 30-39 credits.

If you haven’t worked enough, consider whether your spouse or ex-spouse meets the work history requirement. You may qualify based on their earnings, provided you were married for at least 10 years and are currently unmarried.

Will You Be Automatically Enrolled, or Do You Need to Sign Up?

Not everyone gets automatically enrolled in Medicare. If you are already receiving Social Security benefits at least four months before turning 65, enrollment in Medicare Parts A and B is automatic. You’ll receive your Medicare card in the mail before your coverage begins.

However, if you are not yet collecting Social Security, you must sign up yourself. You can apply online through the Social Security Administration’s website, by phone, or in person at a local office. Missing your initial enrollment window could mean late enrollment penalties and a gap in coverage.

Do You Need to Sign Up for Medicare Part B Now or Later?

Medicare Part B covers outpatient care, preventive services, and doctor visits. Unlike Part A, Part B has a monthly premium. The 2025 standard premium is $185 per month, with higher-income individuals paying more.

If you are still working and have health coverage through your employer (or your spouse’s employer), you may be able to delay enrolling in Part B without penalty. Employers with 20 or more employees usually provide creditable coverage, allowing you to delay enrollment until you retire. However, once your employment ends, you must sign up within an eight-month Special Enrollment Period (SEP) to avoid penalties.

Will You Need Additional Coverage Beyond Original Medicare?

Original Medicare (Parts A and B) does not cover everything. You are responsible for deductibles, coinsurance, and out-of-pocket costs. In 2025, the Part A deductible is $1,676 per benefit period, and the Part B deductible is $257 annually.

To help with these costs, many beneficiaries consider additional coverage options such as a Medigap policy or Medicare Part D for prescription drugs. If you’re considering an alternative to Original Medicare, Medicare Advantage (Part C) plans offer bundled coverage, but costs and benefits vary widely.

Are You Aware of the Late Enrollment Penalties?

Enrolling in Medicare late can result in lifelong penalties. The Part B late enrollment penalty is a 10% increase in your monthly premium for every 12-month period you were eligible but didn’t enroll. Similarly, the Part D penalty applies if you go 63 days or more without creditable prescription drug coverage, adding a permanent increase to your monthly premium.

These penalties can be avoided by enrolling on time and ensuring you have continuous coverage. If you delay Part B due to employer coverage, ensure your employer plan is creditable before making decisions.

What Should You Consider if You Plan to Keep Working Past 65?

Many people choose to continue working past 65 and delay Medicare enrollment. If your employer provides creditable health coverage, you may not need to enroll in Medicare right away. However, it’s essential to compare your employer’s plan to Medicare’s benefits to determine which offers better coverage.

If your employer has fewer than 20 employees, Medicare typically becomes your primary coverage, meaning you should enroll in Part B when you turn 65. If you have an employer-sponsored Health Savings Account (HSA), enrolling in any part of Medicare will prevent you from making new contributions to the HSA.

Have You Considered Your Spouse’s Medicare Needs?

If you have a spouse who depends on your employer’s health plan, delaying Medicare could impact their coverage. Medicare does not provide dependent coverage, meaning your spouse will need their own plan when you transition to Medicare.

If your spouse is younger than 65 and relies on your job-based coverage, you may want to consider how your Medicare enrollment affects their healthcare options.

Make the Right Choice for Your Medicare Enrollment

Applying for Medicare is a significant step in managing your healthcare coverage. Before submitting your application, ensure you understand your eligibility, enrollment timelines, and coverage options. Being proactive will help you avoid penalties and gaps in coverage.

If you still have questions about Medicare eligibility or enrollment, consider speaking with a licensed agent listed on this website. They can provide guidance tailored to your specific needs and help you navigate your options.