Key Takeaways

-

Medicare Advantage plans in 2025 may appear to offer attractive benefits, but hidden limitations can lead to unexpected expenses.

-

Understanding network restrictions, prior authorizations, and out-of-pocket maximums is essential before enrolling.

What Medicare Advantage Really Covers—and What It Doesn’t

Medicare Advantage, also known as Medicare Part C, bundles Medicare Part A (hospital insurance) and Part B (medical insurance) into a single plan. Many of these plans include additional perks like dental, vision, or fitness memberships. However, this package comes with significant trade-offs that are often not apparent until you use the coverage.

While Original Medicare allows you to see any provider that accepts Medicare, Medicare Advantage limits you to a specific network. And that’s only the beginning.

1. Narrow Provider Networks Limit Your Options

Most Medicare Advantage plans use Health Maintenance Organization (HMO) or Preferred Provider Organization (PPO) structures. These require you to see doctors and hospitals within a network. If you go outside the network, you could pay higher costs—or the service may not be covered at all.

This limitation can be especially concerning if you travel often, live in multiple states throughout the year, or want to access top-tier specialists.

2. Prior Authorization Delays Can Affect Your Care

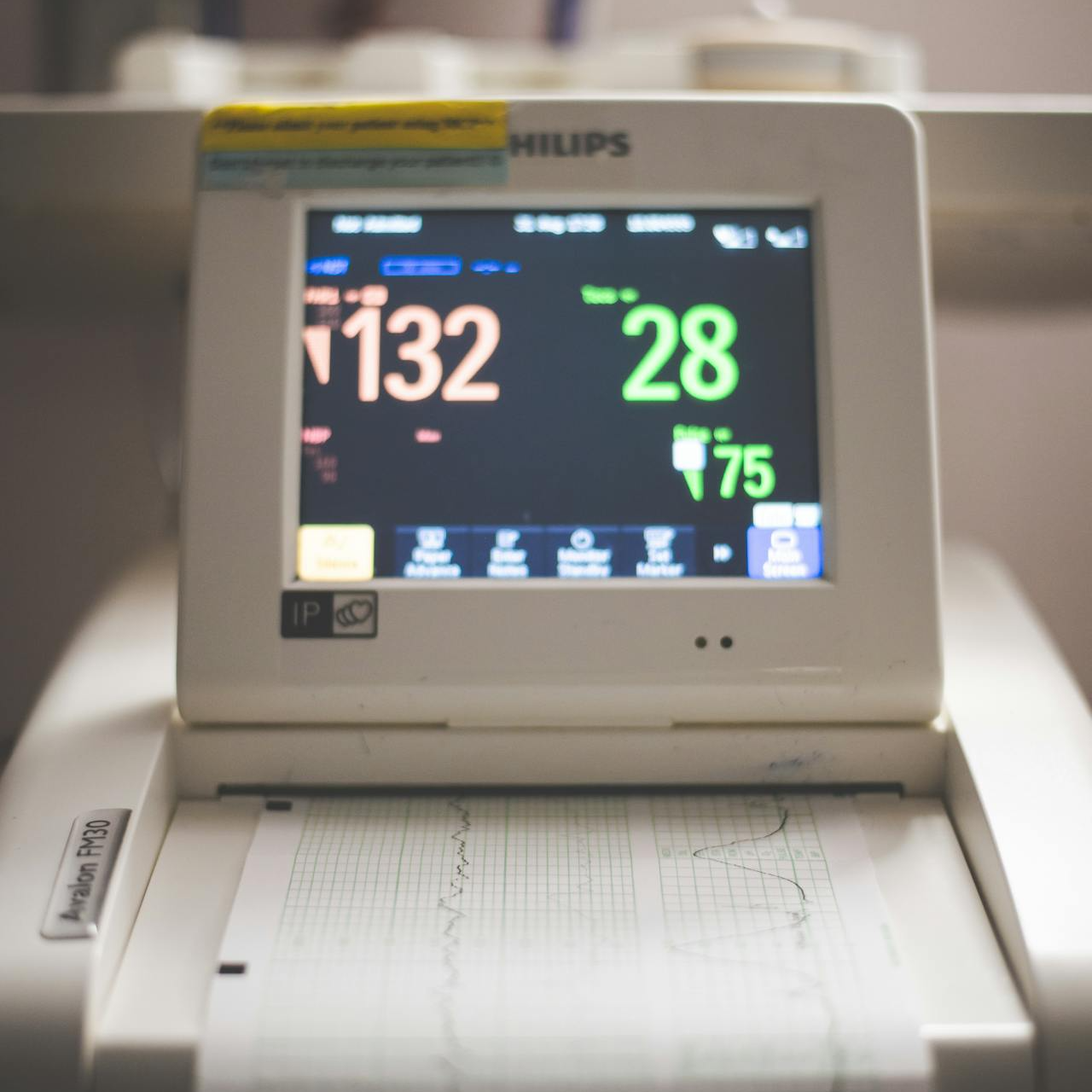

In 2025, prior authorization remains a required step for many services under Medicare Advantage plans. This means your doctor must get approval from the plan before proceeding with certain treatments, tests, or procedures.

This process can delay your care. Even if your doctor recommends a treatment, it can be denied or postponed by the plan administrator. And when time-sensitive care is involved, those delays could have serious consequences.

3. Prescription Coverage Is Not Always Generous

Most Medicare Advantage plans include Part D (prescription drug) coverage. But formularies—the list of covered drugs—can be limited. Plans also use tiered pricing, meaning drugs in higher tiers cost more out-of-pocket.

In 2025, the Medicare Part D out-of-pocket maximum is capped at $2,000, which offers protection. However, the actual access to specific medications can vary. If your prescriptions are not on the plan’s formulary or fall into a high tier, you could face steep costs or be forced to switch medications.

4. Out-of-Pocket Maximums Still Add Up

Every Medicare Advantage plan has an annual out-of-pocket maximum. In 2025, the cap for in-network services is $9,350, and $14,000 for combined in- and out-of-network services.

While this is better than Original Medicare, which has no cap, many beneficiaries underestimate how quickly these limits can be reached. A hospitalization, major surgery, or ongoing specialist visits can bring you close to the threshold.

Additionally, some plans set lower out-of-pocket maximums but offset this by charging higher copays or coinsurance rates.

5. Extra Perks Often Come with Caveats

Many Medicare Advantage plans market their “extra benefits”—like dental, vision, hearing aids, and gym memberships. But these services typically have annual limits, narrow provider networks, or are only partially covered.

For example:

-

Dental coverage may be limited to basic cleanings and x-rays, with caps on coverage for major services.

-

Vision benefits might only include one pair of glasses per year from specific providers.

-

Hearing aids may be covered once every few years, and only from certain brands or audiologists.

These perks are valuable, but they rarely offer the comprehensive coverage people expect.

6. Emergency Coverage Outside Your Area Can Be Spotty

Although Medicare Advantage plans must cover emergency care anywhere in the U.S., how they define “emergency” can vary. You may find your urgent care needs while traveling are not fully covered if the plan disputes whether it was a true emergency.

This uncertainty makes Medicare Advantage less appealing for those who live in more than one location during the year or travel frequently.

7. Switching Back Isn’t Always Easy

Medicare allows you to switch plans during the Annual Enrollment Period from October 15 to December 7. You can also make a one-time change during the Medicare Advantage Open Enrollment Period (January 1 to March 31).

However, switching from a Medicare Advantage plan back to Original Medicare isn’t always straightforward. You may not be able to purchase a Medigap (Medicare Supplement) policy without undergoing medical underwriting unless you qualify for guaranteed issue rights. This can be a major hurdle for those with preexisting conditions.

8. Supplemental Benefits Are Shrinking

In 2025, fewer Medicare Advantage plans offer certain supplemental benefits compared to the previous year. For example:

-

Over-the-counter (OTC) benefits are now included in 73% of plans, down from 85% in 2024.

-

Transportation services have declined to 30% of plans, from 36% in 2024.

Plans are rebalancing their offerings, which means what was available last year may no longer be included.

9. Not All Providers Accept Medicare Advantage Plans

Even if a provider accepts Medicare, they may not contract with your Medicare Advantage plan. This can be especially problematic in smaller towns or rural areas, where choices are already limited.

Before enrolling, you must confirm whether your current doctors, specialists, and hospitals are in-network. Otherwise, you could be forced to switch providers or face out-of-pocket costs.

10. Plan Details Change Every Year

Medicare Advantage plans are not static. Premiums, benefits, provider networks, drug formularies, and cost-sharing can change from year to year. That’s why it’s critical to review your plan’s Annual Notice of Change (ANOC) every fall.

Failing to do so can result in unpleasant surprises, such as increased costs or the removal of a key benefit you were counting on.

What You Can Do to Protect Yourself

If you’re considering Medicare Advantage, here’s how to proceed wisely:

-

Compare Plans Carefully: Look beyond the marketing headlines. Examine the provider networks, drug coverage, and out-of-pocket limits.

-

Check Providers and Medications: Make sure your doctors and prescriptions are included.

-

Review Annual Changes: Read the ANOC sent to you each September. Understand what’s changing before the enrollment deadline.

-

Understand Enrollment Windows: The Annual Enrollment Period (Oct 15 – Dec 7) and Medicare Advantage Open Enrollment Period (Jan 1 – Mar 31) are your opportunities to make changes.

-

Speak with a Licensed Agent: Personalized help can ensure you’re choosing a plan that fits your healthcare and financial needs.

Be Informed Before You Enroll

Medicare Advantage plans may work well for some, but they’re not a fit for everyone. The potential for hidden costs, network restrictions, and annual changes means you need to approach enrollment with a critical eye.

Before signing up, take the time to evaluate your healthcare needs, travel habits, prescription requirements, and budget. If you feel overwhelmed, reach out to a licensed agent listed on this website to walk through the options with you.