Key Takeaways

- Choosing the right Medicare plan is a critical step in ensuring your healthcare needs are met today and in the future.

- Making informed choices about Medicare plans can help you avoid unexpected costs and ensure you receive the coverage you need.

Medicare Isn’t One-Size-Fits-All: Why Your Choice Matters

When it comes to Medicare, many people think it’s as simple as picking any plan and moving on. But the reality? Your choice has far-reaching effects on your healthcare and finances. Medicare plans are diverse, each offering unique benefits and limitations. Choosing the wrong one can lead to unnecessary expenses or limited access to services you need most.

In this guide, we’ll walk you through why selecting the right Medicare plan is so essential and how to approach the decision-making process.

The Foundations of Medicare: A Quick Refresher

To make an informed choice, it helps to understand Medicare’s basic structure. Medicare consists of four parts:

- Part A (Hospital Insurance): Covers inpatient hospital stays, skilled nursing facility care, and some home health services.

- Part B (Medical Insurance): Covers outpatient care, preventive services, and medical equipment.

- Part C (Medicare Advantage): Offers an alternative to Original Medicare, bundling Parts A and B with additional benefits like vision or dental.

- Part D (Prescription Drug Coverage): Covers the cost of prescription medications.

If you’re nearing 65, you’ll likely first enroll in Parts A and B, known as Original Medicare. From there, you can choose to add a Part D plan or opt for a Medicare Advantage plan.

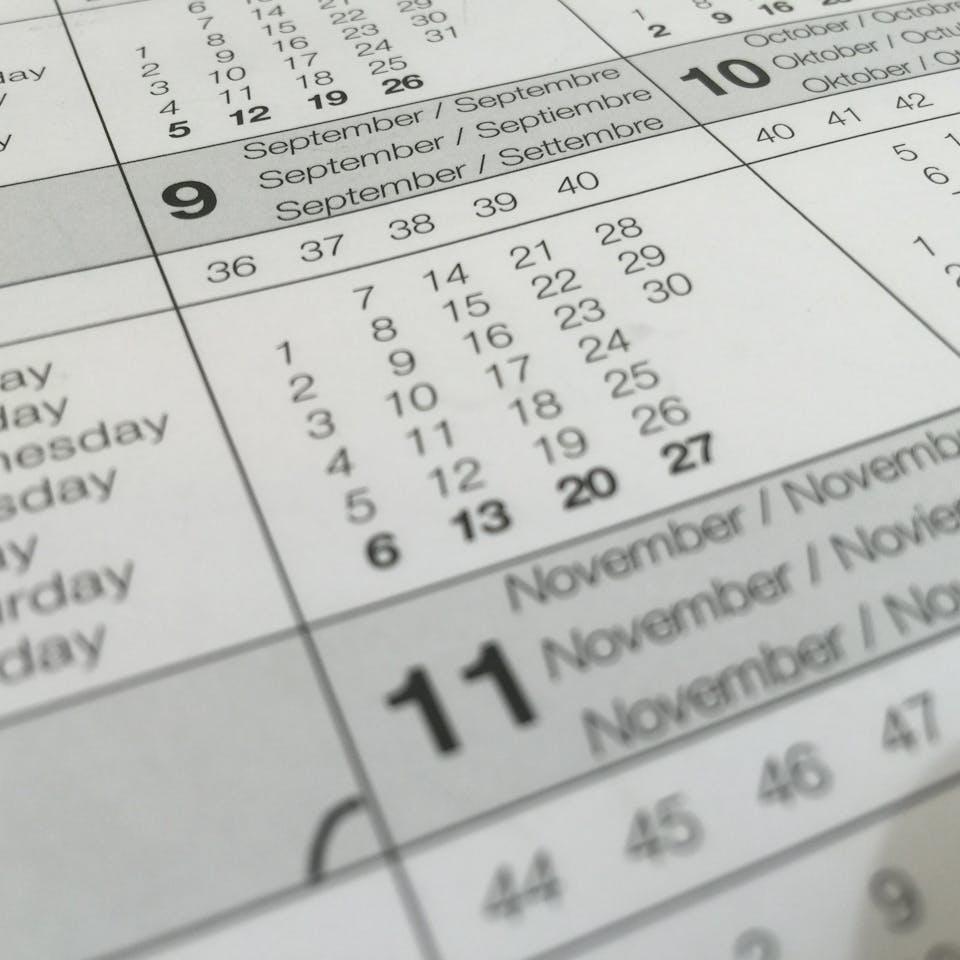

Timing Is Everything: Enroll Wisely

Medicare enrollment periods are crucial. Missing them can mean limited choices and hefty penalties. Here’s what you need to know:

- Initial Enrollment Period (IEP): This is a 7-month window starting 3 months before your 65th birthday month, continuing through your birthday month, and ending 3 months after. Enroll during this time to avoid late penalties.

- Annual Enrollment Period (AEP): Occurs from October 15 to December 7 each year. Use this time to switch plans or adjust your coverage for the following year.

- Medicare Advantage Open Enrollment Period: Runs from January 1 to March 31, allowing those already enrolled in a Medicare Advantage plan to make changes.

- Special Enrollment Periods (SEPs): Triggered by life events like moving or losing employer coverage, SEPs allow adjustments outside regular enrollment windows.

Missing these windows could mean higher costs or limited plan options, so mark your calendar!

Balancing Costs and Coverage

One of the most challenging parts of choosing a Medicare plan is balancing what you’ll pay versus what you’ll get. Here are the main costs to consider:

- Premiums: The amount you pay monthly for coverage.

- Deductibles: The out-of-pocket amount you pay before your plan starts covering costs.

- Copayments and Coinsurance: Your share of costs after deductibles are met.

- Out-of-Pocket Maximums: The most you’ll pay in a year, but only for certain plans like Medicare Advantage.

Each Medicare option has different cost structures. For example, Original Medicare may seem straightforward, but it doesn’t cap out-of-pocket spending. Medicare Advantage plans often do, but their premiums and covered services vary.

Think About Your Current and Future Needs

When evaluating plans, it’s not just about today—it’s about tomorrow, too. Consider these factors:

- Your Health: Are you managing a chronic condition? Some plans offer disease management programs.

- Your Prescriptions: If you take medications, a plan with strong Part D coverage is essential.

- Your Providers: Some plans limit which doctors or hospitals you can visit. Ensure your preferred providers are in-network.

- Additional Benefits: Do you want vision, dental, or hearing coverage? These are often included in Medicare Advantage but not Original Medicare.

- Future Flexibility: Your needs may change. Choosing a plan with adaptable benefits can save you hassle later.

Avoid Common Medicare Pitfalls

Navigating Medicare can feel overwhelming, and mistakes can be costly. Here’s how to steer clear of common errors:

- Don’t Miss Deadlines: Failing to enroll during your IEP or make changes during AEP can result in penalties.

- Avoid Overpaying: Compare plans carefully to avoid paying for coverage you don’t need.

- Check for Coverage Gaps: Ensure your plan covers your essential services, like prescriptions or specialists.

- Understand Part D Penalties: Skipping Part D when you’re eligible can lead to lifelong penalties, even if you don’t take medications now.

The Role of Supplemental Coverage

For those sticking with Original Medicare, consider whether supplemental insurance (Medigap) makes sense for you. Medigap policies help cover costs like deductibles and coinsurance. While they require an additional premium, they can provide peace of mind by limiting unexpected expenses.

Remember, Medigap policies don’t work with Medicare Advantage, so this choice hinges on which route you decide to take.

Medicare Advantage: The Alternative Path

Medicare Advantage plans are an appealing option for many because they often include extra benefits not covered by Original Medicare. However, they come with trade-offs:

- Pros: Additional benefits (e.g., vision, dental), out-of-pocket maximums, and often bundled drug coverage.

- Cons: Limited provider networks and varying out-of-pocket costs.

Before choosing a Medicare Advantage plan, weigh these factors carefully.

Stay Updated on Annual Changes

Medicare plans and costs change every year. Even if you’re satisfied with your current plan, review its benefits annually during AEP. Insurers may adjust premiums, covered services, or network providers, which could affect your satisfaction and budget.

Resources for Making the Right Choice

Feeling overwhelmed? You’re not alone. Fortunately, there are tools to help:

- Medicare Plan Finder: An online tool to compare plans based on your location and needs.

- State Health Insurance Assistance Programs (SHIPs): Offer free counseling to help you navigate Medicare.

- Medicare Customer Service: Provides answers to coverage questions and enrollment concerns.

Taking the time to explore these resources can simplify your decision-making process.

Start Planning Today for a Healthier Tomorrow

Your healthcare future depends on the choices you make now. By understanding your options, evaluating your needs, and staying proactive, you can select a Medicare plan that supports your health and financial well-being for years to come.

Don’t leave your healthcare to chance—start preparing today.